Please see below this week’s Markets in a Minute update from Brewin Dolphin – received late yesterday afternoon – 27/07/2021

Markets hit record highs as earnings beat forecasts

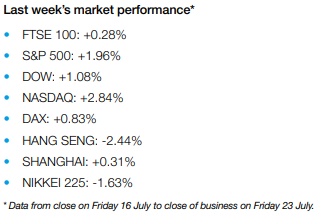

Most major markets went up last week, as second-quarter earnings season in the US continued to demonstrate the robust profitability of the biggest companies.

In the US, the S&P 500 and the Nasdaq Composite went up 2% and 2.8% respectively. A raft of companies, including healthcare giant Johnson & Johnson and telecoms firm Verizon, reported second-quarter earnings that beat expectations. The benchmark more than recovered from the fall of the previous week, when inflationary concerns preoccupied the market.

The pan-European Stoxx Europe 600 rose 1.5%, also hitting a record high. Dutch technology company ASML was among those to report earnings that met with the market’s approval. ASML shares are up nearly 50% yearto-date.

The UK’s FTSE 100 edged up 0.3%. Outside the top flight, private equity firm Bridgepoint showed the strength of the market, rising 29% on the first day of its trading following its IPO in London.

China’s Shanghai index also edged up. However, the index fell back on Monday 26 July with regulation affecting education, property and technology sectors.

Shares were mixed on Monday, as investors braced for another slew of earnings.

British Airways owner IAG was among the risers in London. As the industry recovers from Covid-19, more flights are resuming. Normality may be some way off, but some investors remain optimistic about the industry’s prospects. The number of new Covid-19 cases in the UK has fallen for several days.

However, as the Guardian puts it, passengers “are arriving in countries where the Delta variant paralysing Britain is just becoming dominant – and Europe is responding by clamping down”.

Some countries have tightened border controls, with Malta barring entry to unvaccinated travellers and Germany bringing in stricter quarantine rules for people arriving from Spain and the Netherlands. More broadly, authorities from Greece to Italy and France to Portugal are bringing in what are effectively vaccine passports for a wide range of activities, although most are shying away from using that term, which has become incendiary.

Pingdemic

Meanwhile, concerns remain that some businesses are having difficulty operating because of the ‘pingdemic’, where people are unable to work because they have received notification on their phone saying they have to self-isolate.

Under pressure, the UK government changed its stance last week and said some double-jabbed staff at some critical organisations would be allowed to take tests to keep coming to work, rather than self-isolating.

Still, the EY ITEM Club forecasts that the UK will see GDP growth of 7.6% this year, the fastest growth since 1941. It forecasts 6.5% growth in 2022.

It said the expectations of a bounce-back in consumer spending and supportive macroeconomic policy contributes to the largely positive economic outlook.

But EY adds that questions remain over inflation prospects. It said inflation will be 3.5% by the end of 2021, adding that how consumers will tap into pandemic savings remains to be seen.

Shell, slew of techs to report

Oil giant Shell is among the companies scheduled to report second-quarter earnings.

The S&P 500 was little changed in early trade on Monday. It hit another record on Friday, buoyed by companies reporting strong second-quarter earnings. Among the major technology companies reporting after the close on Tuesday are Apple, Microsoft and Alphabet. Facebook and Amazon report on Wednesday and Thursday respectively.

Aon-WTW merger off

Meanwhile, in the insurance industry, Aon and Willis Towers Watson said they were scrapping their merger deal and would end litigation with the US Justice Department. The deal was first announced in March 2020. The companies said that, despite regulatory momentum around the world, including the recent approval of the combination by the European Commission, they reached an impasse with the US Department of Justice.

Aon shares increased about 7%, although it will have to pay Willis Towers a termination fee of $1bn. Both companies will provide further financial updates and outlook with their second-quarter earnings, reported MarketWatch. Aon is due to report on 30 July.

Regulation hits China shares

In China, the Shanghai Composite fell 2.3% on Monday. Some shares have been hit by new regulation in education, property and tech. Reuters reported that the CSI Education Index fell 9.6% to its lowest close in 16 months. The shakeout in China’s $120bn private tutoring sector follows Beijing’s announcement on Friday of new rules barring for-profit tutoring in core school subjects to ease financial pressures on families. The policy change also restricts foreign investment in the sector through mergers and acquisitions, franchises, or variable interest entity (VIEs) arrangements.

The weekend also brought new regulatory moves targeting technology and property, sparking selloffs in those sectors in Hong Kong and mainland markets on Monday, Reuters reported.

Another quick update from Brewin Dolphin, these updates are a good way of keeping up to speed with developments in the markets.

Please continue to check back for our latest updates and blog posts.

Charlotte Ennis

28/07/2021