Please see article below from BMO Global Asset Management – received yesterday 14/10/2021

Steven Bell monthly update – Investing in the time of COVID

Despite the success of vaccines, the virus may put pressure on hospitals in the northern hemisphere as winter sets in; these are headwinds for equities and we could see a 5-10% correction before year end.

The global economic recovery has run into a string of supply shortages, from natural gas to key workers to silicon chips. Inflation has risen. Central banks still maintain that it is temporary, but the pressures are such that the Bank of England and US Federal Reserve may have to raise rates earlier than the market had expected. Despite the success of vaccines, the virus may put pressure on hospitals in the northern hemisphere as winter sets in; these are headwinds for equities, and we could see a 5-10% correction before year end. But the longer-term outlook for risk assets is positive with a notable capex boom likely to boost productivity and corporate earnings.

• Vaccination rates are higher in Europe but the indoor season is approaching for northern countries too, so expect another wave of hospitalisations.

• The UK is enjoying an improvement in new cases, new hospital admissions haven’t risen as fast as expected recently, especially in England. But there are still far more people in hospital with Covid in the UK on a per capita basis than most European countries. Double the number in France and five times those in Italy, Germany and the Netherlands.

• Covid precautions have reduced the number of available beds in the UK by 6,000, and we started off with fewer beds per capita than most other developed market countries. The crisis here is far from over.

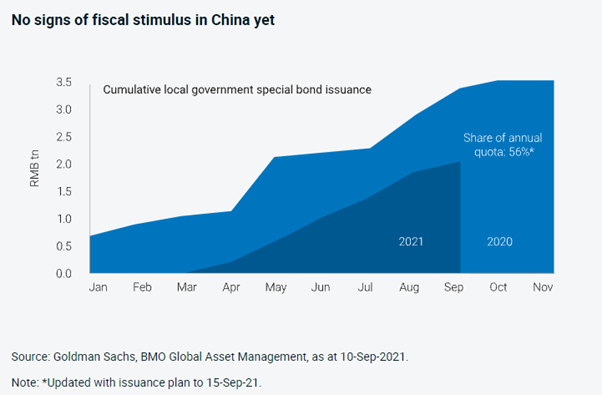

• The crisis at Evergrande is a symptom of a wider structural change. China is weaning itself off a credit-fuelled construction boom with Beijing preferring ‘quality’ over ‘quantity’ in terms of economic growth.

• An energy crisis is leading to shutdowns in key sectors; the economy is slowing.

• A policy response is coming but it has been delayed by inflation concerns and the desire to avoid further fuelling excessive credit growth.

• Used car and car rental prices have started to ease in the US, signalling that some bottleneck price pressures are beginning to ease.

• Having increased over the past 12 months, US inflation expectations have now stabilised at around 2%.

• But signs of a pick-up in wages suggest that either profit margins are squeezed or that inflation could stay high for longer.

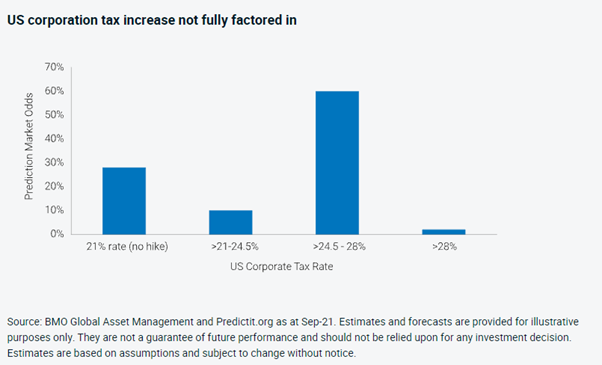

• Although analysts forecasts for Q3 US company earnings look too low, they also haven’t fully factored in the impending corporation tax increase, and earlier-than expected rate hikes due to rising wages will squeeze profit margins. We could see a 5-10% correction in markets before year end.

• Equity markets have stumbled recently as developed market central banks have suggested that official interest rates could be headed higher sooner than markets expect.

• However, a boom in capex orders in the US and elsewhere is a major positive for the longer term, boosting productivity and corporate earnings.

Please continue to check back for our latest blog posts and updates.

Charlotte Clarke

15/10/2021