Please see below article received from AJ Bell yesterday, which discusses the long-term picture after the latest US Federal Reserve meeting delivered a shock.

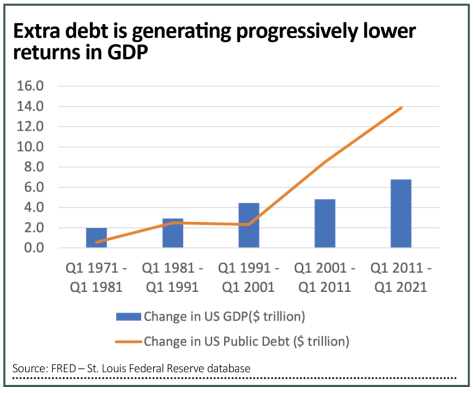

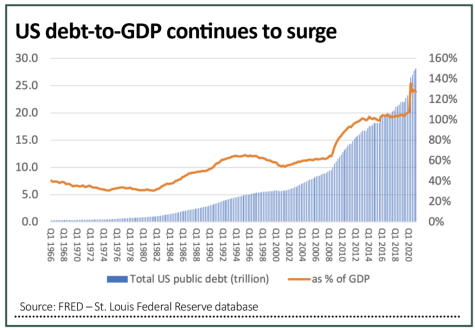

During the first 200 years of its existence, the US accumulated a cumulative federal debt of $1 trillion, the equivalent of 30% of its GDP (gross domestic product). In the last 40 years, that figure has surged to $28 trillion.

The good news is that the US economy has grown too, as annual GDP has advanced from around $3 trillion to $23 trillion. As a result, America’s national debt-to-GDP ratio has therefore grown from roughly 30% to 128% and that is bad news for two reasons.

First, it means that it is taking ever-increasing amounts of debt to generate an extra dollar of GDP.

Second, it leaves the US sitting well above the 80% to 90% debt-to-GDP ratio described by economists Kenneth Rogoff and Carmen Reinhart as a key tipping point, whereby economic growth would slow thanks to (unproductive) debt servicing costs – although that research, used by many governments as the basis for austere fiscal policies in the last decade, has since been widely challenged.

Whether you side with Reinhart and Rogoff or their detractors, the challenge that faces the US Federal Reserve is undeniable.

The US central bank needs to keep interest rates as low as it can to help the US government fund its interest payments even as it maintains welfare programmes, spends on defence, education and other vital needs, such as investment in public infrastructure.

That may leave the Fed having to raise interest rates to fend off inflation, maintain the value of the dollar relative to other currencies and maintain its credibility with financial markets and also holders of US treasuries, since they are effectively bankrolling America’s economy.

Investors now have to assess which way they think the Fed (and the White House) will go and to what degree the central bank’s ultimate policy path is priced into bonds, equities, commodities and currencies.

In the end, every option available to the chair Jay Powell and president Biden may help in some areas but do damage in others, as if to confirm the view of Stanford University professor Thomas Sowell that: ‘There are no solutions, only trade-offs.’

Multiple options

To make a reasoned decision here – and then draw up an appropriate asset allocation – investors will need to think like the Fed and its officials. History is very clear that there are only four ways out once a national debt reaches America’s current levels, relative to GDP:

Rapid economic growth. This is the best option, but it is not proving easy, if the period from 2009 and the end of the financial crisis is any guide. This underpins the push toward Modern Monetary Theory and the argument that governments should spend on productive assets and focus on the long-term payback rather than worry about near-term borrowing.

Default. This is not ideal, as serial offenders like Argentina will attest. It leaves you locked out of international debt markets and means you must pay higher coupons even if you can persuade someone to lend to you. It can also prompt capital flight, hitting both your currency and value of other assets and financial markets. The US will not countenance anything that jeopardises the dollar’s status as the world’s reserve currency (although most other developed countries face the same dilemmas and policy options).

Inflate. This is more like it and is exactly what the US and UK did when debt ballooned thanks to the Second World War. Rebuilding programmes and public spending fuelled growth, interest rates were kept below inflation and lenders were repaid in effectively devalued currency as a result. Yet again, though, this leaves the Fed with the dilemma of stoking some inflation but not too much that investors take fright and both financial markets and the wider economy are destabilised, as happened in the 1970s.

War. This is the option that no-one in their right minds would consider, even if the new Cold War between China and America feels like it is getting steelier by the month, even if president Biden is now in the White House rather than Donald Trump. Taiwan is still a potential flashpoint for ‘Hot War’, both territorially and technologically, thanks to Taipei’s predominance in the global silicon chip supply chain.

Path of least resistance

If growth is unlikely (or least relies on wanton government borrowing and overspending) then inflation still appears the likeliest outcome, but the Fed will not want to tighten policy too far, too fast. Just look at how financial markets are welcoming talk of two Fed rate hikes to the far-from-challenging level of 0.75% by the end of 2023. Equity and commodity price wobbled and volatility indices such as VIX moved higher.

Yet the US 10-year treasury yield fell, the last thing you would expect if inflation is coming, especially when yields are already miles below the current rate of increases in the cost of living.

These trends may not be as mutually exclusive as investors might think. The Fed is still running QE (quantitative easing) flat out to massage yields lower. There is more uncertainty now over its policy direction than there has been for some time. Investors seek havens, like bonds, at times of concern.

Perhaps the bond and stock markets are getting ready for the return of volatility and bumpier times ahead. But then the chances of the Fed raising rates or hauling in QE may recede further, as the end of the debt-fuelled bull market and economic upturn would surely be seen as deflationary and any policy response would have inflation as its ultimate goal.

We will continue to publish relevant content, market updates and news as we optimistically push towards the end of lockdown restrictions in the UK.

Stay safe.

Chloe

28/06/2021