Please see below article received from Brooks Macdonald this morning, which provides a global market update with reference to political and economical developments in the US.

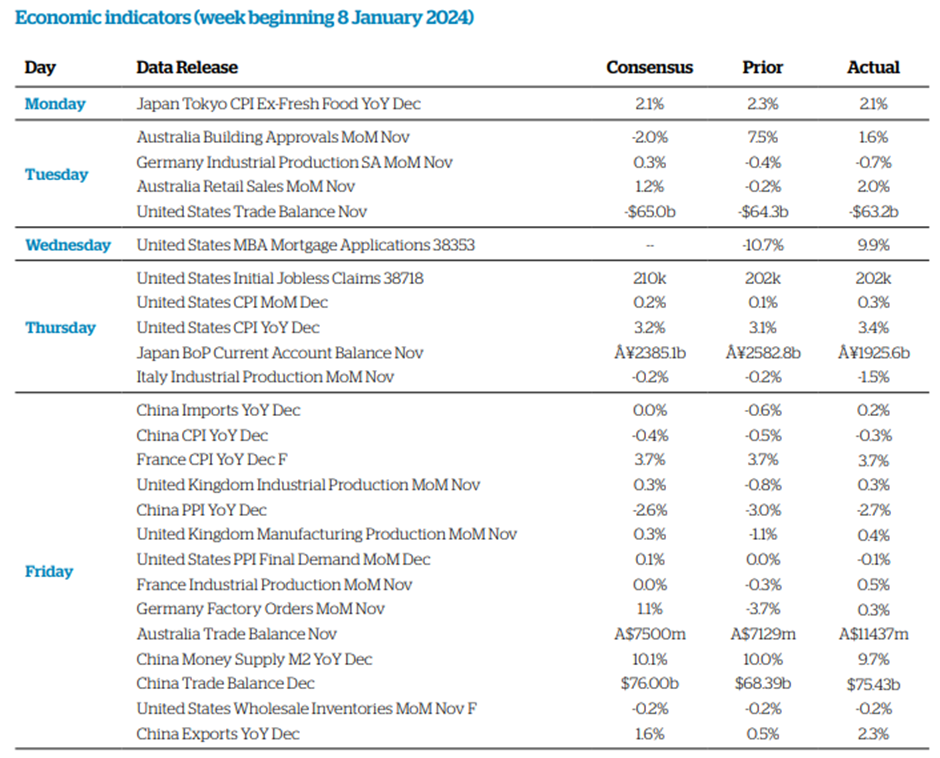

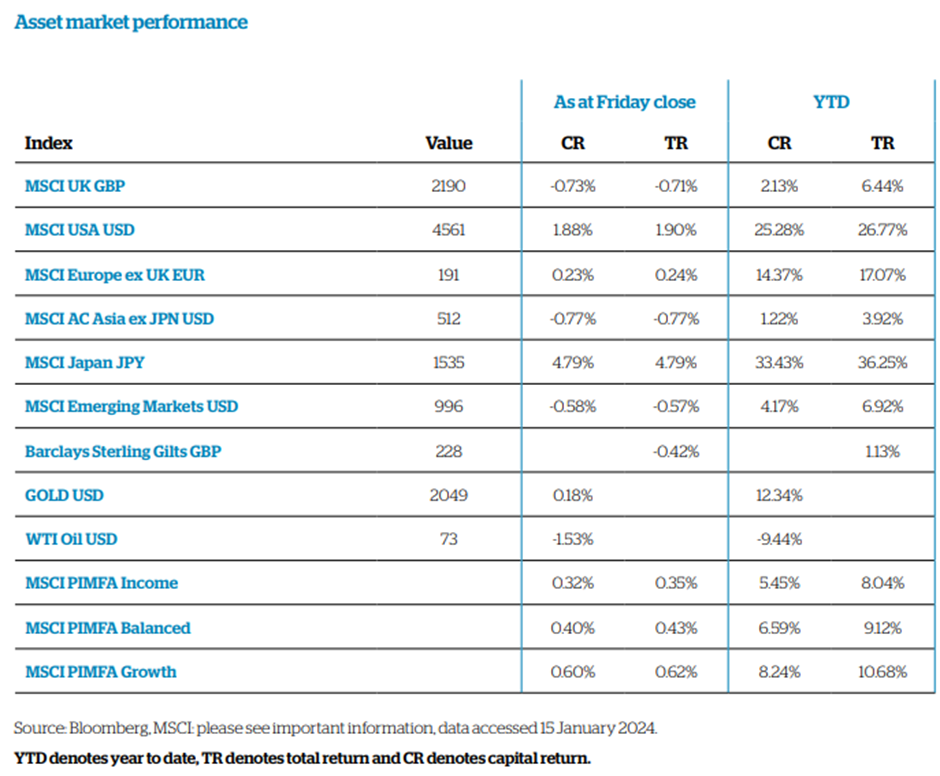

Despite an upside beat to US CPI last week, US bond markets became more confident that the Federal Reserve would cut interest rates in Q1 2024. Against this backdrop the US equity market rose almost 2%, with the index now less than half a percentage point away from its all-time high. Today will see a slow start to the new week with the US on holiday for Martin Luther King Day.

Despite US markets being closed, there will be some US headlines later today after the Iowa Caucus which will be a test of Republican appetite for a Trump nomination. Recent polls have pointed to a significant lead for Trump however commentators will be waiting to see if he can achieve 50% of the vote which would lock out any contenders regardless of vote switching as rivals drop out. Taiwanese politics will also be in focus after the presidential election which saw the incumbent Democratic Progressive Party (DPP) win with just over 40% of the vote. The DPP’s leader, William Lai Ching-te has previously been labelled a separatist by Beijing therefore markets are wary of any escalatory rhetoric in the aftermath of this win. So far neither Beijing nor the DPP have said anything to stir tensions, but this remains one to watch.

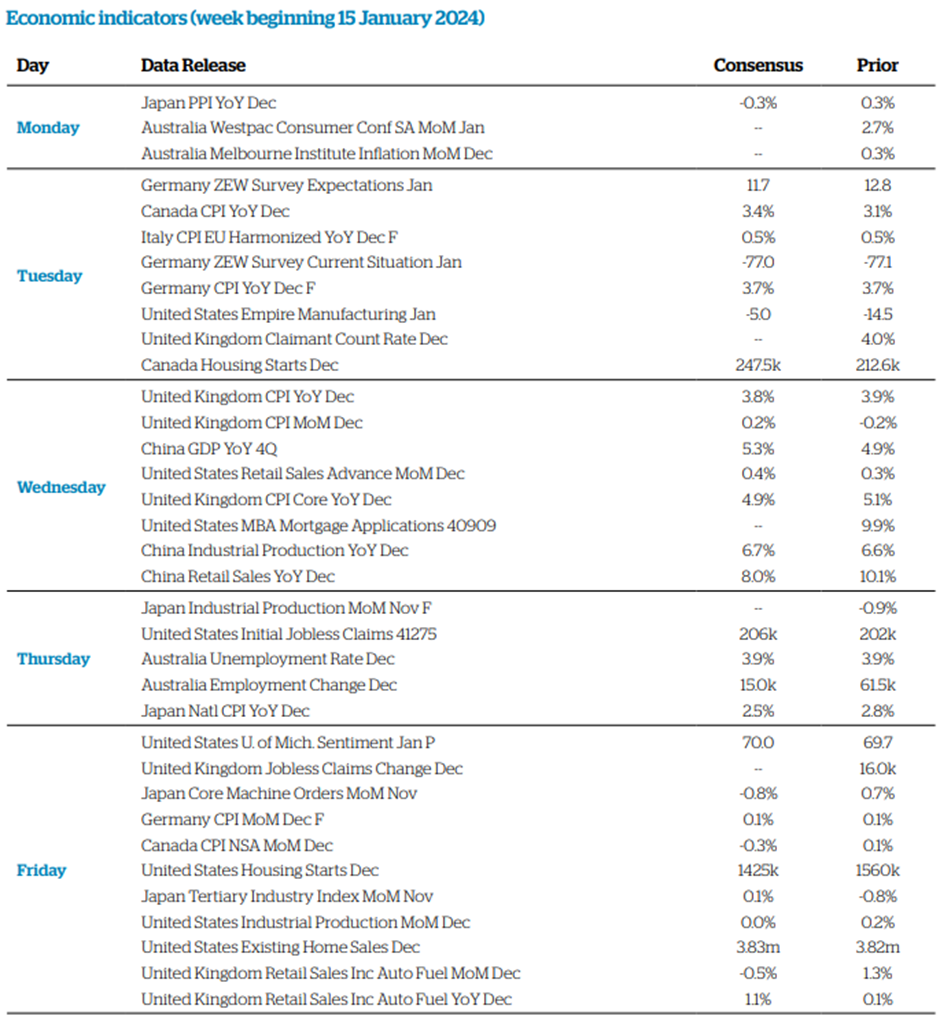

Alongside a busy week for the US earnings season, we will receive the latest US retail sales numbers for December. Given the importance of the month for sales, this will give an insight into consumer momentum as we continue through 2024. Housing data and the latest University of Michigan consumer survey will also be worth noting. In the UK, we have a large set of important data points including labour market measures on Tuesday and retail sales on Friday. The most important release will be the UK CPI report, on Wednesday, with the Bank of England hoping for continued signs of disinflation.

The Bank of England is eager to tilt towards a more balanced, or even accommodative, monetary policy. UK economic data has broadly flatlined in recent quarters, suggesting a stagnating economy. The Bank of England faces a very different backdrop to the US where economic momentum continues to feed the demand side of the inflation story. If UK CPI continues to come down the market could find the UK central bank changing its tune quite rapidly.

Please check in again with us soon for further relevant content and market news.

Chloe

16/01/2024