Please see the below article from Evelyn Partners detailing their thoughts on the Fed’s decision to continue to hold interest rates at their present level. Received this morning 14/12/2023.

What happened?

The Federal Open Market Committee (FOMC) voted to keep rates on hold at 5.25-5.5% for the third meeting in a row. This marks the end of the US tightening cycle.

What does it mean?

Last night we received some good news from across the pond: the US Federal Reserve signalled that the tightening cycle is over, and it will pivot to easier monetary policy next year.

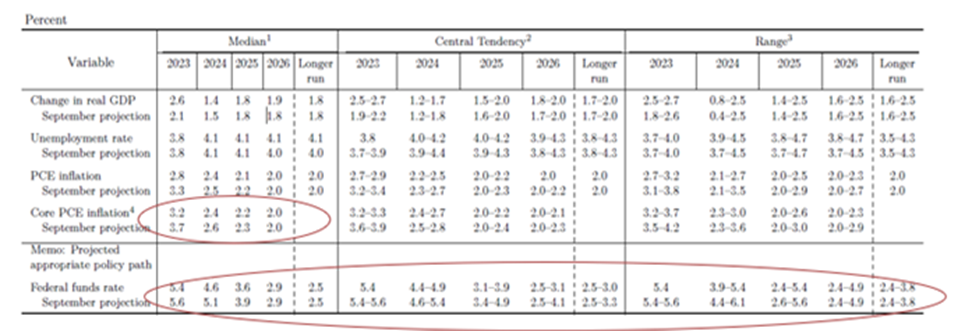

This signal came via three sources. First, the summary of economic projections, which collates the forecasts of committee members, showed that monetary policy is likely to be easier next year. The projections show that the median expectations for interest rates in 2024 were revised down from 5.1% to 4.6%—a notable move given that the previous forecasts were only submitted 3 months. This change was driven by a major downside surprise in the recent inflation data: the committee now expects core PCE inflation to be around 3.2% for 2023, instead of 3.7%.

Second, the dot plot – which maps the committee’s projections in more detail – also showed a notable decline in interest rates in the coming years.

In response, the Fed funds futures, which capture market-implied future interest rates, moved to price in 6 cuts next year, instead of the 4 expected before the meeting. The Fed isn’t expected to cut at its next meeting in January, but the market then anticipants three consecutive cuts from March to June, and it assigns a high probability of cuts in July and September.

Third, Chair Powell half-heartedly pushed back against the market’s dovish interpretation of this evidence. He noted that it was “too early to declare victory” but admitted that the committee had been talking about when to cut rates. He also said that the Fed would need to start cutting rates “way before” inflation reached its 2% target. These statements imply the next step will be to cut rates.

Unsurprisingly, markets rallied strongly on this news. The S&P 500 and Nasdaq gained ~+1.4%, while the US 10-year yield fell below 4% having topped 5% as recently as September.

Bottom Line

Last night the US Federal Reserve signalled that the tightening cycle is over, and it will pivot to easier monetary policy next year.

Unsurprisingly, markets rallied strongly on this news. The S&P 500 and Nasdaq gained ~+1.4%, while the US 10-year yield fell below 4% having topped 5% as recently as September.

Please check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

14/12/2023