Please see below article received from Brooks Macdonald yesterday afternoon, which provides a global market and economic update.

- China continues to be a global inflation outlier, with consumer price pressures absent, while producer prices fall further into outright deflation

- Central banks from US, Europe and Japan decide on interest rates this week, hot on the heels of surprise hikes from Australia and Canada last week

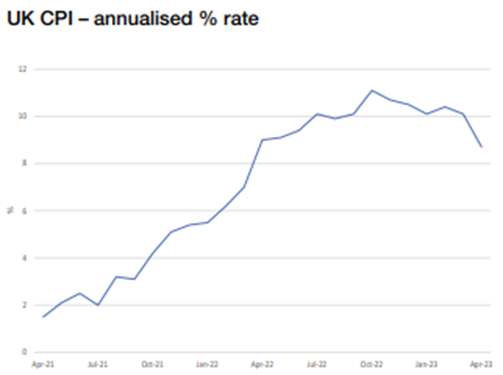

- US consumer price inflation in focus this week, and while inflation rates are expected to fall, core prices are still being judged as relatively stickier

- The flipside of sticky inflation, economic growth is proving more resilient, as UK Confederation of British Industry (CBI) last week upgrades its economic outlook for this year and next

What happened last week and what are the highlights ahead for markets this week

Global equities arguably had a better week last week than bonds, thanks to continued resilience of large cap US technology stocks in particular. For bond markets meanwhile, surprise hikes from central banks in Australia and Canada spooked bond investors, as they worried about the read-across for the US Federal Reserve (Fed) who meet later this week. Yields on US 10-year Treasuries were up +4.9 basis points (bps) on the week (including +2.1bps on Friday), finishing the week at 3.74%. Looking to the week ahead, we have central bank interest rate policy decisions, in calendar order from the Fed (Wednesday), the European Central bank (ECB, Thursday), and the Bank of Japan (BoJ, Friday). For the Fed, ahead of the meeting, we also get the latest May monthly reading of US CPI (Consumer Price Index) inflation on Tuesday. Rate hikes this week are thought to be most likely to come from the ECB, with the Fed expected to ‘skip’ a hike until July, while the BoJ is expected to continue to stay unchanged. In economic data due elsewhere, US Retail Sales are due Thursday and before that UK monthly GDP (Gross Domestic Product) for April is due Wednesday – expectations are for a month-on-month gain of 0.2%.

China continues to be a big global inflation outlier

Against the sticky and still-high inflation ‘run-of-play’ that we are seeing in most developed economies globally at the moment, economic data out from China on Friday gave markets an important reminder that the world’s second-biggest economy has a very different message: China continues to be a global inflation outlier. China’s latest CPI print for May edged up only slightly to 0.2% year-on-year (versus 0.1% year-on-year in April), while PPI (Producer Price Index) deflation looked entrenched, plunging -4.6% year-on-year. On PPI specifically, it was the eighth straight month of producer deflation and the steepest fall since February 2016. All in all, with inflation currently absent in China, that leaves its central bank with lots of room for manoeuvre to support its economy over the reminder of this year, should it be needed.

Central banks from US, Europe and Japan decide on interest rates this week, hot on the heels of surprise hikes from Australia and Canada

Last week’s central bank meetings from the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) are an important lead into this week in terms of how their actions has shaped expectations. Both the RBA and the BoC had been expected to leave their rates unchanged, but in the event, both hiked by 25bps. The BoC was particularly noteworthy – after its previous last hike in January, the Canadian central bank had signalled a pause, keeping rates on hold at their March and April meetings. That willingness to sit back however disappeared last week, and Canadian interest rates, at 4.75%, are now at 22-year highs. Driving the increased hawkishness has been inflation stickiness, a theme common to many central banks recently – in Canada’s case, annual CPI inflation rose to 4.4% in April, the first increase in 10 months.

The most important central bank of them all? US Federal Reserve meets

The focal point this week is the Fed rate announcement due Wednesday. For this week, Fed Funds futures are currently pricing in a circa 30% probability of a June hike of 25bps. By contrast, it seems the Fed might yet ‘skip’ a hike in June, only to post a rate-hike at their following meeting in late-July, where the probability of a hike rises to circa 55%. Also, important to look at this week with the Fed’s statement will be their latest Summary of Economic Projections, including their so-called ‘dot-plot’ of interest rate expectations. Feeding into the Fed’s rate decision will be the US CPI print due tomorrow. While the CPI ‘all-times’ annual rate is expected to drop to 4.1% in May (from 4.9% in April), much of that drop comes from the tougher comparative last year when energy and food prices were soaring. For the core CPI print (excluding energy and food prices), this is expected to be running higher at 5.3% but still down on April’s 5.5%.

The flipside of sticky inflation, economic growth is proving more resilient

For most western economies, inflation continues to be above target, especially in the case of core prices. Driving this inflation stickiness however, the flipside is that GDP data for some economies is proving to be somewhat more resilient than had been feared at the start of this year. Take the UK for example – estimates out last Friday from the UK CBI point to +0.4% GDP growth this year (up from a contraction of 0.4% previously), followed by +1.8% in 2024 (versus +1.6% previously). As the CBI noted in its press release “the [UK] economy looks to have fared better than expected in first half of 2023, and is set to steer clear of a recession … tailwinds to growth have strengthened since our previous forecast in December 2022: the global outlook has improved”.

Please check in again with us soon for further relevant content and market news.

Chloe

13/06/2023