Please see below article received from Brooks Macdonald yesterday afternoon, which provides a detailed market commentary as we head into August.

- Better inflation data buoys hopes that the US economy might be able to pull-off a soft landing

- Bank of Japan intervenes to dampen government bond yield moves

- Company Q2 earnings reports reach the half-way point, so far so good

- Another interest rate hike expected from the Bank of England later this week

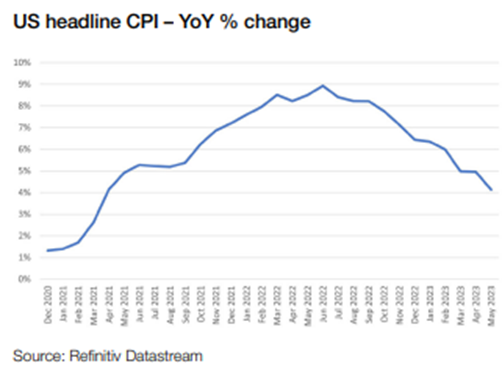

Better inflation data buoys hopes that the US economy might be able to pull-off a soft landing

Markets finished last week in positive mood, as softer US inflation data increasingly suggested the economy might be able to pull-off a so-called ‘soft’ landing (where economic growth slows but avoids recession). Buoying sentiment, both US personal consumption prices and employment costs saw annual gains come in a shade weaker than expected. Looking forward, this week is a relatively busy one for data. It starts with Eurozone consumer inflation later this morning, followed by the US Federal Reserve’s (Fed) latest Senior Loan Officer Opinion Survey on bank lending out later today. Central bank decisions are due from the Reserve Bank of Australia on Tuesday and the Bank of England (BoE) on Thursday. Elsewhere, after last week’s better US Gross Domestic Product (GDP) Q2 print, this week we get some US purchasing manager survey data on manufacturing and services on Tuesday and Thursday respectively. Wrapping up the week, the US monthly non-farm jobs report is out on Friday, where the consensus is looking for 200,000 jobs added in July.

Bank of Japan intervenes to dampen government bond yield moves

After the Bank of Japan (BoJ) surprised markets last Friday by effectively loosening its grip on its yield-curve-control monetary policy, this morning we have been reminded that there still limits to how far the BoJ wants to travel for now. Earlier today the BoJ announced an unscheduled Japanese Government Bond (JGB) purchase operation, spending 300bn yen (around $2.1bn) to buy 5-to-10-year bonds at market yields. This looks consistent with BoJ Governor Kazuo Ueda’s comments last week that the BoJ was ‘not ready’ to allow yields to move freely. It is also interesting that in last week’s latest BoJ forecasts, while it raised its median estimate for fiscal 2023 core consumer inflation (Consumer Price Index (CPI) all items less fresh food and energy) to 3.2% from 2.5% previously, there was no change to fiscal 2024 at 1.7% or fiscal 2025 at 1.8%, which both sit below the BoJ’s 2% inflation target.

Company Q2 earnings reports reach the half-way point, so far so good

We are now half-way through the US company results season, with 51% of US large-market-capitalised companies having reported Q2 results. According to the latest Factset ‘earnings insight’ report, 80% have reported Earnings Per Share (EPS) above consensus, which is above the 10-year average of 73%. Revenues are also so far proving resilient, with 64% of companies reporting revenues above consensus, just about better than the 10-year average of 63%. Meanwhile the longer-term earnings outlook appears to continue to push-back against wider recession fears, with calendar year-on-year earnings growth expected to rise from a flat +0.4% this year, to +12.6% in 2024. Markets are discounting machines, calibrating expected future outcomes into asset prices today. With a strong year-on-year pickup in earnings growth expected next year, that is helping to give oxygen to markets currently.

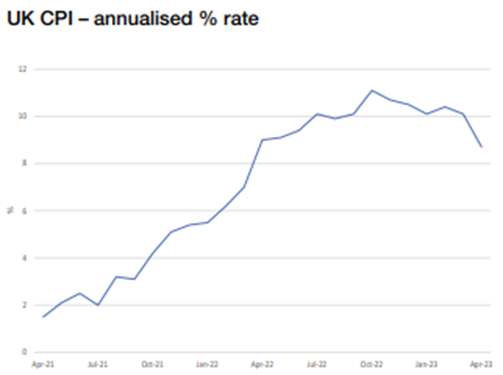

Another interest rate hike expected from the Bank of England later this week

After hikes from both the Fed and the European Central Bank last week, the BoE is expected to follow suit on Thursday. It is still a bit of a close call however between a 25 basis points (bp) or 50bp hike, The BoE will be weighing up strong wage data on the one hand, but against this, there was the better-than-expected consumer inflation data. On balance, markets expect the BoE to hike by 25bps (which would take interest rates up from 5.00% currently, to 5.25%, which would be the BoE’s 14th consecutive hike in this cycle) but reiterate data-dependency for its forward guidance.

Please check in again with us soon for further relevant content and market news.

Chloe

01/08/2023