Please see the below article from Brooks Macdonald detailing their discussions on the macro-economic environment and ongoing geopolitical risk. Received this morning 07/08/2025.

What has happened

Equity indices were somewhat mixed on Wednesday. In the US, while a new all-time high for the “Magnificent Seven” group of megacap US tech stocks (up +1.93% yesterday), led the US S&P500 equity index up +0.73%, more than half of the S&P500 constituents were down on the day. Furthermore, the US smaller company Russell 2000 equity index was an outright faller, down -0.20% yesterday. Over in Europe meanwhile, the pan-European STOXX600 equity index also finished the day lower, down -0.06% (all in local currency terms). Later today at 12 o’clock UK time, the Bank of England is widely expected to cut interest rates by 25 basis points, from 4.25% currently, to 4.00%.

More Trump trade tariff news

US President Trump yesterday announced an additional 25% tariff on goods from India going into the US in response for India’s continued buying of Russian oil exports. This stacks on top of the 25% tariff for India announced last week, and which would leave India later this month facing a cumulative 50% rate. Trump was blunt in his justification, saying that India is “fuelling the [Russian] war machine [against Ukraine]. And if they’re going to do that, then I’m not going to be happy”. Separately, yesterday saw Trump announce he would be imposing “a tariff of approximately 100% on chips and semiconductors”, though for companies moving production back to the US, such as Apple, “there will be no charge” said Trump.

Apple plans more US investment

Apple’s share price gained +5.09% yesterday (in US dollar terms) on news the company is investing an extra US$100bn in US domestic manufacturing. According the White House, it will bring more of Apple’s supply chain to the US, as well as giving the US more domestic control over critical component assembly. Apple had previously announced plans to spend $500bn in the US over 4 years, so this latest sum is on top of that.

What does Brooks Macdonald think

According to Bloomberg data, fixed income derivative markets were yesterday pricing in over 100 basis points of interest rate cuts from the US Federal Reserve (Fed) by mid-2026. However, why interest rates are expected to be cut matters – whether it is because of easing inflation, or a weaker economic picture, each can have very different market impacts – indeed, historically, stock markets don’t tend to do as well when central banks are cutting rates into the start of a recession for example, versus against a soft-landing scenario back-drop. With US and global equity indices currently close to record (dollar) all-time highs despite the mounting risks from higher trade tariffs, the economic growth outlook arguably matters even more than usual.

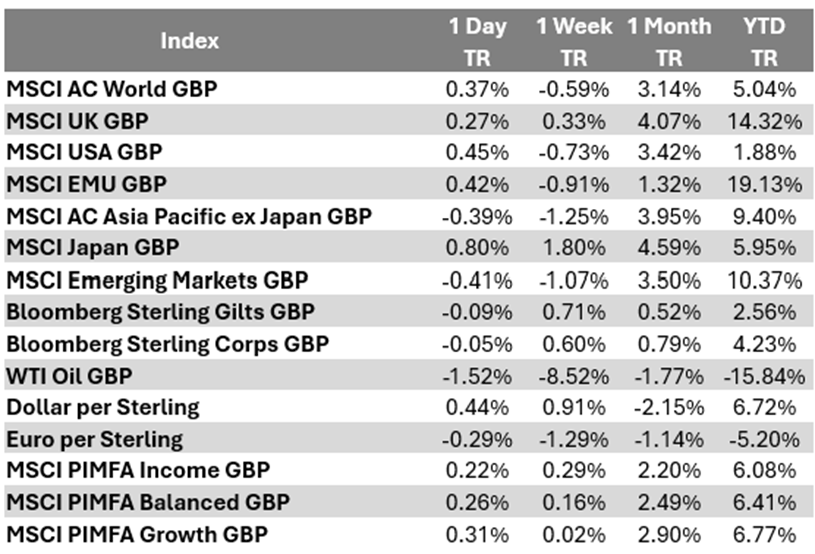

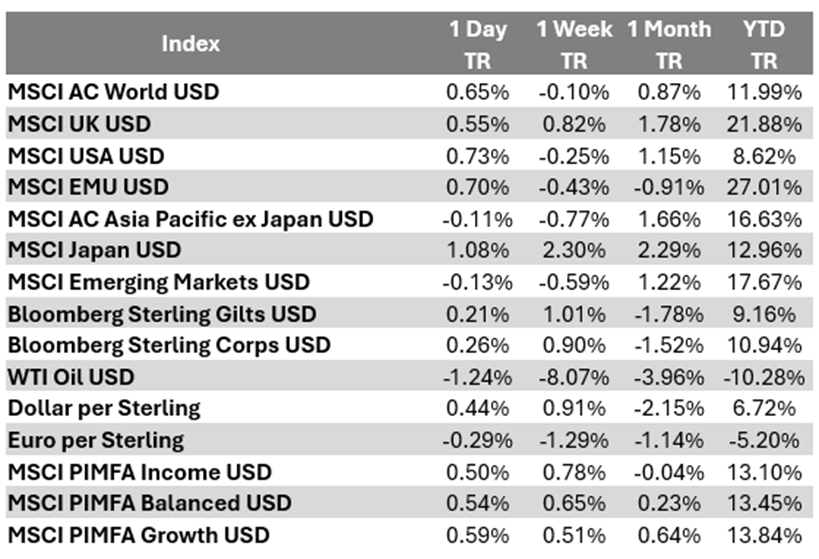

Bloomberg as at 07/08/2025. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

07/08/2025