Please see the below article from Brooks Macdonald detailing their discussions on Geopolitical developments and Fed independence. Received this morning 13/01/2026.

What has happened?

Geopolitical developments in Venezuela and Iran continued to draw attention, while US prosecutors launched a criminal investigation that has revived some fears around central bank independence. Precious metals surged to fresh highs, with gold (+1.97%) reaching $4,598/oz and silver (+6.57%) rising to $85.10/oz. Brent crude (+0.84%) also climbed to a seven week high of $63.87/bbl. Yet equities were largely unfazed: the S&P 500 (+0.16%) and Europe’s STOXX 600 (+0.21%) both closed at new records. Financials lagged, with the KBW Bank Index (-0.95%) under pressure after Trump called for a 10% cap on credit card interest rates. Among the large tech names, the Mag 7 (-0.03%) had a mixed session, though Alphabet (+1.00%) became the latest to surpass a $4trn valuation after securing a multi year agreement to provide AI capabilities for Apple devices.

Market brushed off concerns around Fed independence

Concerns over Fed independence initially pressured US assets, but the reaction proved short lived. Treasury yields briefly steepened before settling only modestly higher, the US dollar weakened slightly, and equities fully reversed early losses to close at new highs. The limited market move reflected growing scepticism about the likelihood of meaningful political intervention. Key Senate Republicans, including Thom Tillis of the Banking Committee and Lisa Murkowski, signalled opposition, raising doubts about the feasibility of any challenge to the Fed’s autonomy. Investors also appear mindful that the administration has previously stepped back when bond market volatility risked lifting mortgage rates. With Powell’s term ending in May, leadership changes are already expected. Still, the next few weeks remain important, with the Supreme Court considering the Lisa Cook case on 21 January ahead of the FOMC meeting on 27–28 January.

What does Brooks Macdonald think?

Risk assets have absorbed political noise well, but incoming data will continue to shape the near term narrative. Attention now turns to today’s US CPI release. The previous print appeared softer but was viewed cautiously due to data collection issues during the US government shutdown, particularly an unusually sharp slowdown in shelter inflation. A more reliable dataset this month should offer clearer insight into underlying price trends. A stronger than expected CPI reading could revive rate cut uncertainty, while confirmation of easing inflation would support the current risk on tone.

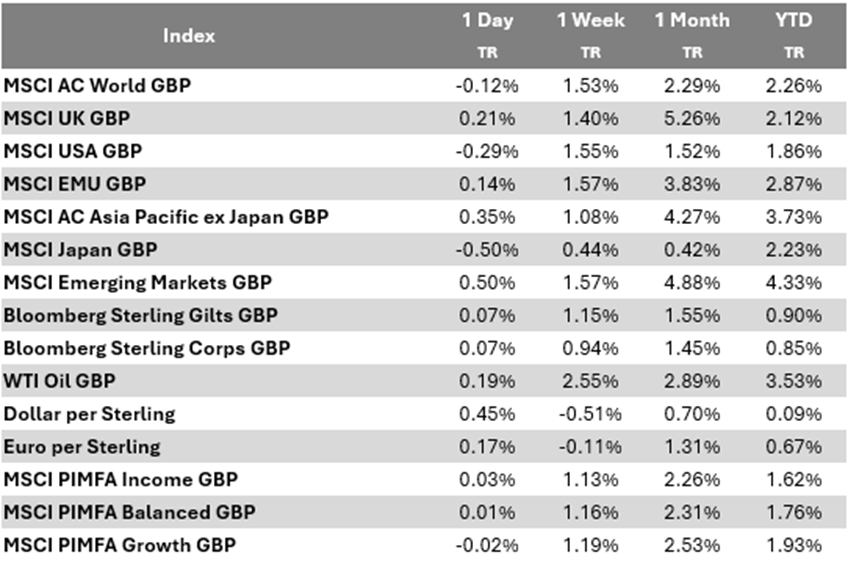

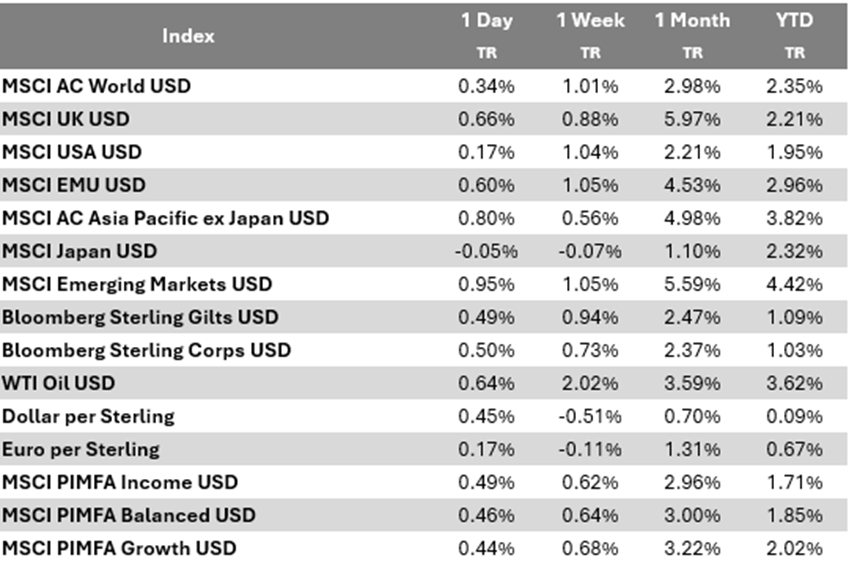

Bloomberg as at 13/01/2026. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

13/01/2026