Please see below, Brooks Macdonald’s ‘Daily Investment Bulletin’ which provides a brief analysis of the key factors currently affecting global markets. Received this afternoon – 21/12/2023

What has happened?

The relentless march higher of US equity markets was interrupted late on Wednesday with the headline index off c. -1.5% on the day. The catalyst is not clear however after markets have traded solely in one direction for several weeks, regardless of central bank speakers or the incoming data, a snap back is arguably warranted.

Central banks

Despite the negative tone within equity markets, bond markets continued their rally with the US 10-year Treasury yield falling to 3.85% while the 2-year yield is now just 4.33%. Investors continued to ramp up their expectations of imminent interest rate cuts with bond markets now implying a 92% probability of a cut by March and 1.5% of cuts next year in totality. One of the factors that may have caused the sharp sell-off late yesterday is the growing gulf between the Fed’s dot plot of interest rate expectations and what is priced into the market.

Inflation

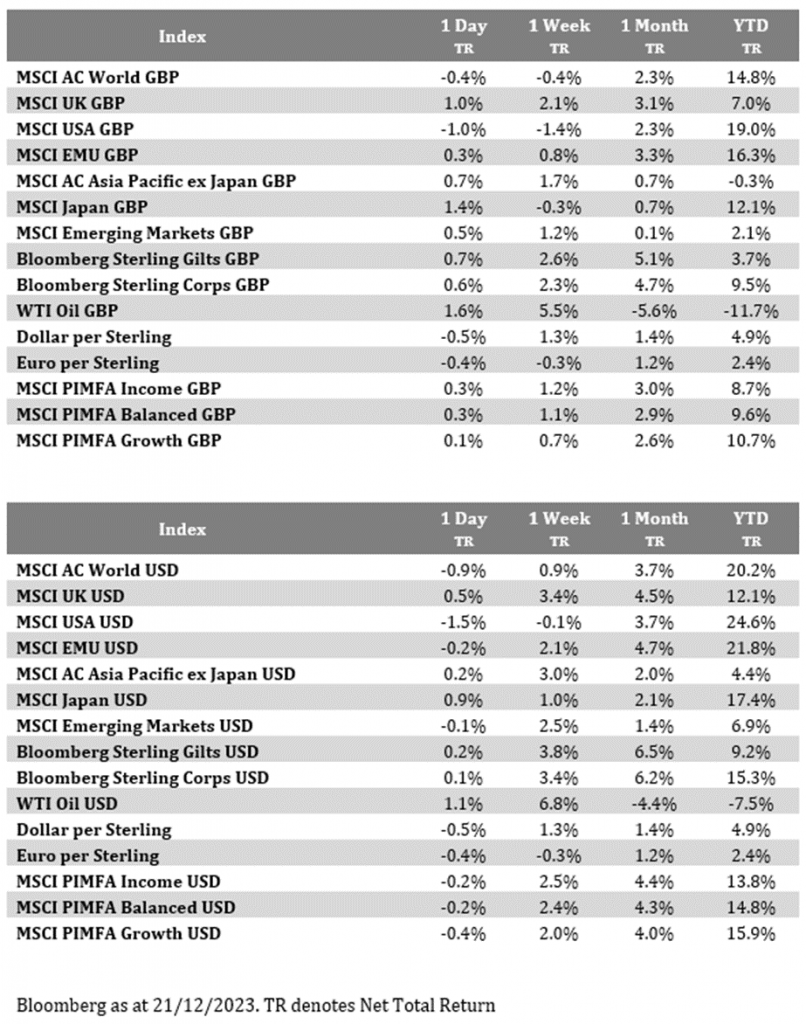

There was good news for the UK yesterday as headline CPI inflation fell more than the market was expecting to 3.9%. This was 0.4% below expectations but the Core CPI number, which excludes food and energy, saw an even more dramatic move lower, coming in at 5.1% versus 5.6% expected. Investors increased the number of interest rate cuts they are expecting from the Bank of England in 2024 and the gilt yield curve rallied. Over in Germany, the Producer Price Index inflation numbers showed significant deflation with the index contracting by -7.9% year-on-year compared to -7.5% expected. This helped European bond markets share in the rally seen in the US and UK.

What does Brooks Macdonald think?

On top of the positive inflation stories yesterday, the Conference Board’s US consumer confidence showed a resilient US consumer. Despite this, equities fell quite substantially at the end of the day which suggests a degree of investor fatigue around quite how quickly the market outlook has shifted from bleak at the end of October to unashamedly bullish by the end of the year.

Please continue to check our blog content for advice and planning updates from leading investment managers.

Alex Kitteringham

21st December 2023