Please see the below article from Brooks Macdonald detailing their brief discussion on markets with a focus on the US-China trade spat. Received this morning 14/10/2025.

What has happened?

Markets showed signs of stabilisation yesterday after a turbulent close to last week. One of the main drivers was OpenAI signing a major deal with Broadcom, whose shares surged 9.88%, to acquire 10 gigawatts of advanced computer chips, signalling robust demand for AI infrastructure. The S&P 500 clawed back more than half of Friday’s losses, while Brent crude oil edged up 0.94% to trim its weekly decline. However, Washington remains in gridlock as the government shutdown drags into its third week. Across the Atlantic, European indices posted steady gains. The STOXX 600 rose 0.44%, and the FTSE 100 gained 0.16%. This morning, though, Japan’s Nikkei fell 2.80% amid fallout from the ruling coalition’s collapse. Investors are questioning whether new Liberal Democratic Party leader Sanae Takaichi can secure enough votes to become prime minister.

US-China trade spat

The US-China trade spat reignited Friday when President Trump floated massive tariff hikes on China, including a potential 100% levy, rattling global nerves. Yet, the White House quickly tempered the rhetoric, signalling willingness for a deal to de-escalate tensions, particularly over China’s recent restrictions on rare earth exports. Officials emphasised maintaining pressure on Beijing while reassuring markets that outright escalation isn’t inevitable. US Treasury Secretary Scott Bessent reinforced this on Fox Business, affirming that the Trump-Xi summit in South Korea remains on track. As of this morning, Polymarket has the odds of the meeting at 74%.

What does Brooks Macdonald think?

Monday’s market bounce hints at a resurgence of the ‘TACO’ (Trump Always Chickens Out) trade, where investors wager that Trump will dial back his fiercest trade rhetoric to avoid deeper selloffs. This optimism lifted trade-sensitive names, with the NASDAQ Golden Dragon China Index (tracking US-listed firms heavily exposed to China) jumping 3.21%. As the US earnings season kicks off today, featuring heavyweights like JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup, investors will scrutinise their results in a data-starved environment due to the ongoing US government shutdown. Federal Reserve rate cut, a rebound in capital markets activity, and the absence of downward earnings revisions this quarter should support a bullish view; however, sky-high valuations mean companies must deliver near-flawless results to sustain the rally, leaving little margin for error.

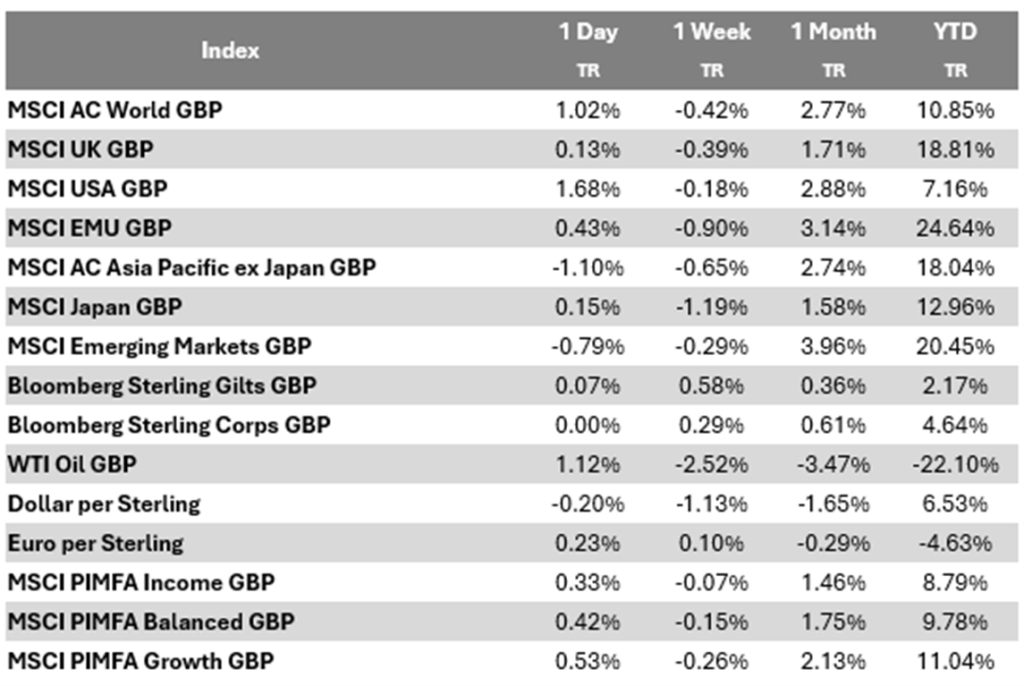

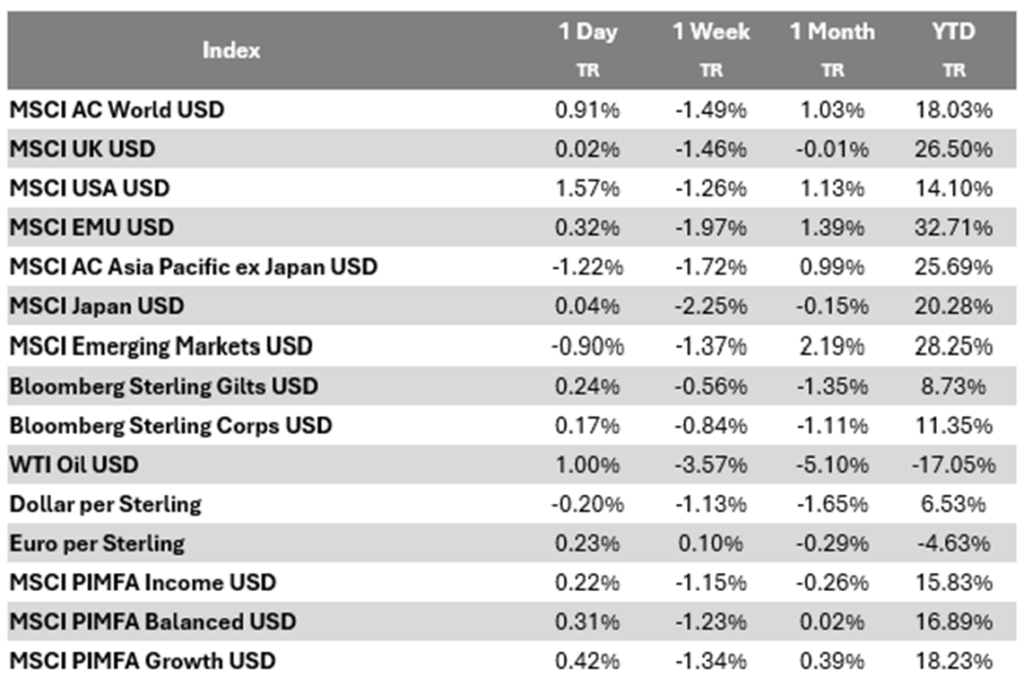

Bloomberg as at 14/10/2025. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

14/10/2025