Please see the below article from Brooks Macdonald detailing their daily discussions on markets and fiscal/political headwinds. Received this morning 30/09/2025.

What has happened?

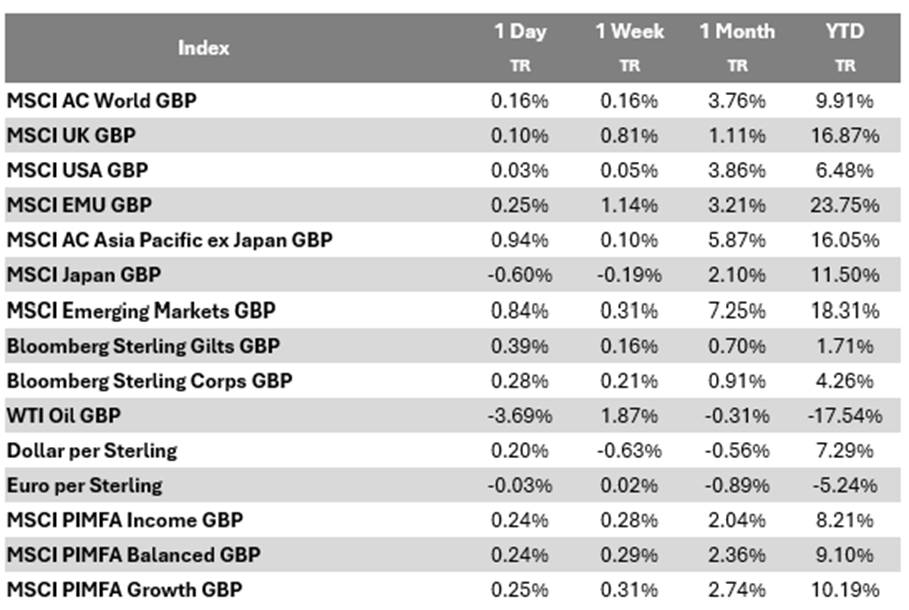

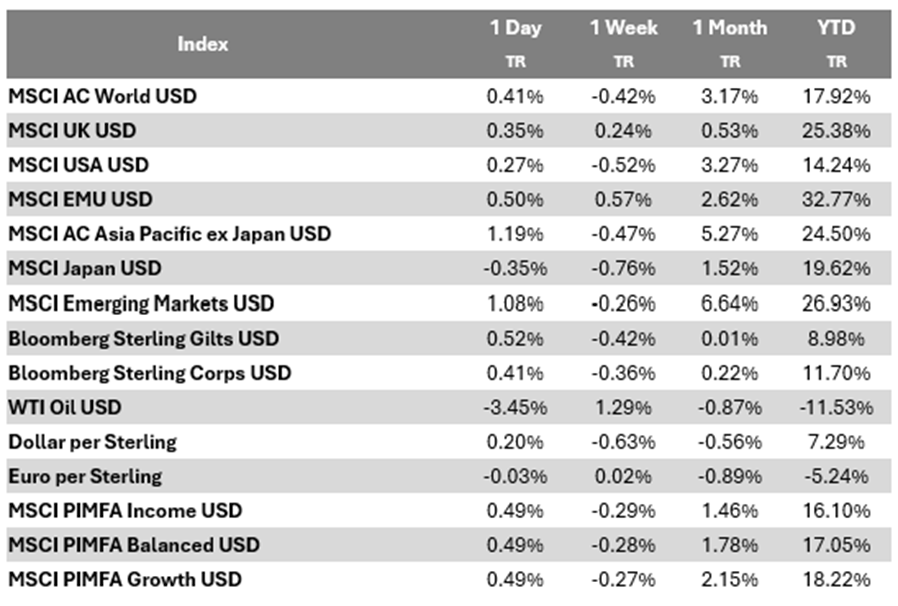

Markets saw a global bond rally yesterday, with 10-year UST yields dipping 3.6 basis points, fuelled by a steep 3.45% decline in WTI crude oil. Signals that OPEC+ may boost production at next week’s meeting eased inflation fears and sparked fresh bets on deeper Fed rate cuts. This lifted most assets: US investment-grade credit spreads tightened 1 basis point to near post-1998 lows, while gold surged 1.96% to a fresh record of $3,834 per ounce. Equities edged higher across the board, as the S&P 500 rose 0.26%, inching within half a percent of last week’s record high. Tech led the charge, with the NASDAQ up 0.48%, but gains were generally broad-based with the equal-weighted S&P climbing 0.32%. In Europe, the STOXX 600 rose 0.18% to a two-week high, and the FTSE 100 added 0.16% to a five-week high.

US government shutdown jitters

With just hours to go, the US government teeters on the edge of shutdown unless a last-minute deal materialises today. The longest shutdown lasted 35 days across the 2018-19 year-end period. Historically, most fizzle out in 2-3 days, with only a few stretching beyond two weeks. Last night’s White House talks with Democratic leaders ended in deadlock, with no follow-ups scheduled. VP Vance hinted at openness to bipartisan fixes for expiring health subsidies (a Democratic priority) but only after reopening the government. Democrats dismissed the offer as too vague. Polymarket odds now peg an 79% chance of shutdown by tomorrow and 85% by year-end.

UK budget blues

In the UK, PM Starmer and Chancellor Reeves are laying groundwork for broader tax hikes, testing Labour’s election vows at the Labour Conference. Long-rumoured fiscal tightening now hints at ditching pledges to freeze income tax, payroll tax, VAT, and corporation tax. Starmer’s Tuesday speech is set to warn that ‘rebuilding Britain won’t come cheap’. Chief Secretary Jones stoked VAT rise chatter, while Reeves sidestepped her no-new-taxes refrain, doubling down on fiscal rules to woo markets. Investors, though, are wary: A Deutsche Bank poll ranks the UK second only to France among major economies for a debt crisis risk in the next two years.

What does Brook Macdonald think?

Amid these fiscal and political headwinds, trade tensions simmered anew as Trump outlined fresh tariffs: a 10% levy on imported timber and lumber. The sting is softened for trade partners with existing deals, whose rates stay capped by prior agreements. Meanwhile, US-China friction escalated with the White House expanding its export blacklist to snare subsidiaries of blacklisted firms, possibly affecting giants like Huawei and SMIC. These measures are likely to sustain uncertainty in global trade and supply chains. As the full effect of tariffs is yet to be captured by the real economy, investors need to stay vigilant ahead.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

30/09/2025