Please see the below article from Brooks Macdonald detailing their discussions on Trump, War in Ukraine, and Bond Markets. Received this morning 19/08/2025.

What has happened

Equity markets logged a quiet session yesterday, with the S&P 500 dipping slightly by -0.01% for its second straight day of losses. The Magnificent 7 group fared a bit worse, down -0.16%. Sentiment took a hit from hawkish shifts in rate expectations and disappointing data, including the NAHB housing market index unexpectedly dropping to 32 in August (versus 34 expected). In Europe, the STOXX 600 inched up +0.08% to a three-month high, showing muted reaction to ongoing geopolitical talks. Brent crude oil rose +1.14% yesterday as ceasefire prospects dimmed.

Trump pushes for Ukraine-Russia talks, but hurdles remain

Ukrainian President Zelenskiy and European leaders met President Trump at the White House. Trump is working to set up a direct meeting between Putin and Zelenskiy, posting on Truth Social that he’d called Putin to ‘begin arrangements.’ Zelenskiy expressed readiness, but the Kremlin remains noncommittal, with Putin’s aide Ushakov offering vague comments about elevating talks between Russia and Ukraine. Security guarantees for Ukraine were another key focus. Trump said that European nations would lead these, coordinated with the US, while Zelenskiy hailed it as a ‘major step forward’ and suggested formalisation within 10 days. NATO’s Rutte echoed the push for details soon, and the FT reported Ukraine offering to buy $100 billion in US weapons, funded by Europe, to bolster the deal. Tensions persist, though. Trump sees no need for a ceasefire before talks, unlike France’s Macron and Germany’s Merz, though Zelenskiy also dismissed a ceasefire precondition.

Bond markets push back on rate cut expectations

Doubts are mounting about the Federal Reserve’s pace of rate cuts in the coming months. This shift builds on last Thursday’s hotter-than-expected US PPI data, showing producer prices rising at the fastest pace since March 2022. With inflation still above target and potentially exacerbated by tariff effects and financial conditions remaining loose, markets are growing cautious. Futures now price in 53 basis points of cuts by December. In the UK, gilts sold off as Bank of England cut expectations cooled. A December cut is now priced at 50/50 chance. Yields rose accordingly, with the 30-year hitting a post-1998 high of 5.61% (+4.7bps) and the 10-year reaching 4.74% (+4.1bps), its highest since May.

What does Brooks Macdonald think

The Trump-Putin summit didn’t seal a deal, but a softer tone is emerging, signalling the start of more meaningful negotiations. Prospects for peace look brighter than earlier this year, yet significant hurdles loom, especially bridging gaps on territory and negotiating security guarantees for Ukraine that Moscow will accept. Separately, this week ramps up with retail earnings: Home Depot, Lowe’s, Target, Walmart and others. Mixed Q2 results are likely amid tariff and immigration uncertainties. Investors will be watching for clarity on tariff impacts, as retailers may soon face higher costs, potentially squeezing margins or raising consumer prices.

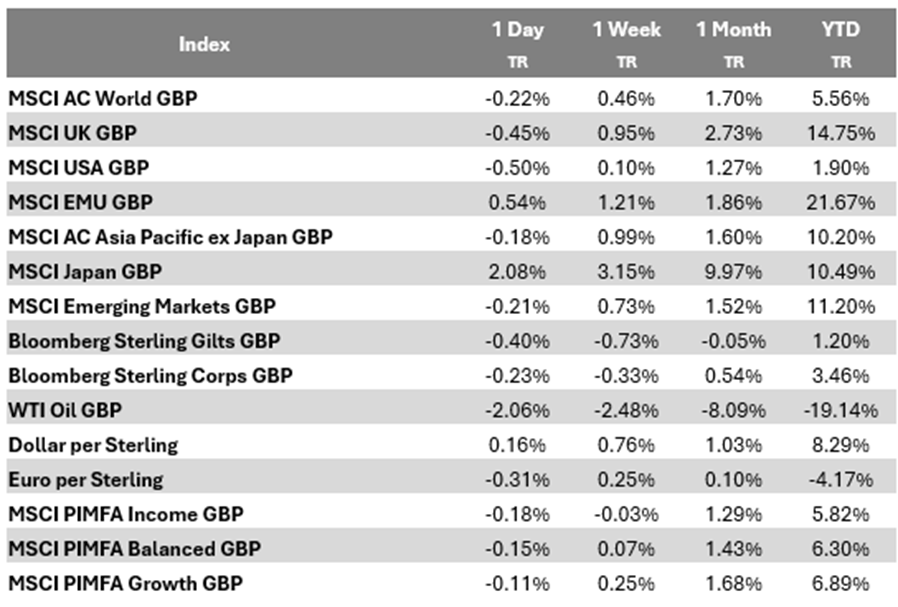

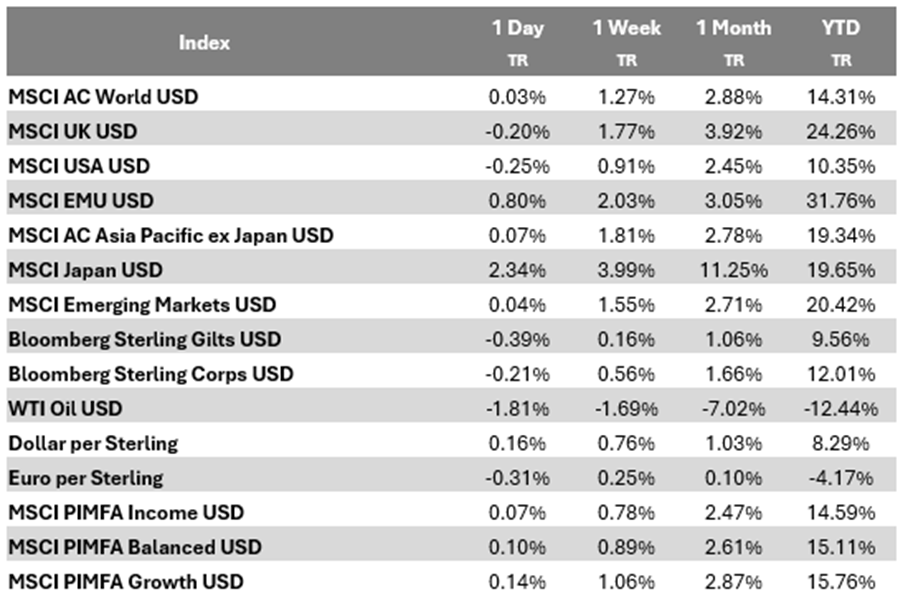

Bloomberg as at 19/08/2025. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

19/08/2025