Please see below, todays Daily Investment Bulletin from Brooks Macdonald covering their thoughts on markets and the ongoing Geopolitical Issues:

What has happened

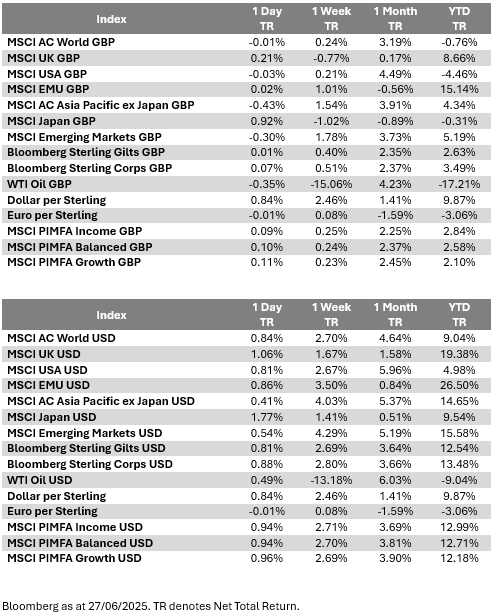

The US S&P500 equity index edged up +0.80% in US dollar price return terms yesterday, leaving it just 0.05% below its February record. In contrast, the broader MSCI All Country World Index (also in US dollar price return terms) has already got there – hitting another fresh all-time closing high yesterday and in doing so notching up its seventh fresh record high this month. That performance picture however includes a boost from a weaker US dollar currency so far this year – for context, in sterling price return terms, that same global equity index is still below its January record high.

US-China trade deal finalised

US Commerce Secretary Howard Lutnick said last night that the US and China have now finalised a deal codifying the Geneva trade talks back in May – the deal includes a commitment from China to deliver rare earth metals, following which, Lutnick said the US would “take down our countermeasures”. Separately, Lutnick said US President Trump is preparing to finalise a slate of trade deals in the next two weeks and expected to follow the US tax cut bill which is going through Congress currently. On the tax cut bill, there was good news here too, as Section 899, a “revenge tax” provision (which would have hiked taxes on foreign investors and companies from countries deemed to discriminate against US companies) has been scrapped.

US inflation data due

Later today, at 1.30pm UK time, we get the US Personal Consumption Expenditure (PCE) inflation data for May. The Bloomberg median forecast is for a +0.1% month-on-month rise in core PCE (which excludes food and energy prices). If that is the number, it would cap the third month in a row of +0.1% month-on-month prints, and it would equate to a 1-month annualised rate of just +1.21%, well below the US Federal Reserve’s +2% inflation target – in turn, also likely increasing pressure on the US Federal Reserve to cut interest rates.

What does Brooks Macdonald think

It is worth keeping an eye on UK government bond markets in the run-up to the planned government welfare reform vote next Tuesday. The planned savings from the bill were expected to help the Chancellor keep within fiscal rules, however given internal Labour party opposition, that now looks in doubt. How the government’s fiscal maths gets squared later this year in the Autumn budget is not yet clear but higher taxes and/or higher borrowing are likely to adversely impact UK economic growth and gilt yield near-term outlooks.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Andrew Lloyd

27th June 2025