Please see the below article from Brooks Macdonald detailing their discussions on the ongoing conflict in the Middle East and interest rates. Received this morning 20/06/2025.

What has happened

Global equity indices were lower on Thursday, as a US decision whether to attack Iran appeared to remain on a knife-edge. Later, with US markets shut for “Juneteenth” holiday and after European markets had closed for the day, US President Trump gave a message effectively saying he was giving Iran up to 2 weeks to negotiate a deal aimed at limiting Iranian nuclear capabilities. With Middle East escalation paused for now, oil prices are down overnight while most Asian equity markets are up this morning.

Middle East

White House press secretary Karoline Leavitt last night delivered a dictated message from Trump, saying that “based on the fact that there’s a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks.” Meanwhile, the US has continued to build up its military presence in and around the Middle East – the US Navy’s newest and most advanced aircraft carrier, the USS Gerald Ford has this week been ordered to deploy to the Mediterranean Sea and is set to become the third US carrier strike group to be positioned in or near the Middle East.

UK interest rates on hold

While UK interest rates yesterday stayed at 4.25% as expected, the Bank of England’s 9-member Monetary Policy Committee (MPC) saw a surprise dovish split: 3 MPC members voted for a 25 basis point cut, 1 more than expected, and versus 6 MPC members who voted for no change. In addition, Bank minutes released yesterday echoed the context for more possible cuts later this year, citing weak economic growth and clearer signs of loosening in the UK labour market. Looking forwards, the Bank continued to see the “gradual and careful” withdrawal of monetary policy restraint remaining “appropriate”.

What does Brooks Macdonald think

With the surprise dovish tilt to the Bank of England’s latest meeting this week, that has fed into the UK interest rate outlook. Looking at market expectations yesterday afternoon, based on derivative option pricing, that pointed to 50.1 basis points (bps) of cumulative interest rate cuts by the Bank of England’s December meeting later this year, with a first 25 bps cut fully-priced-in for the Bank’s September meeting.

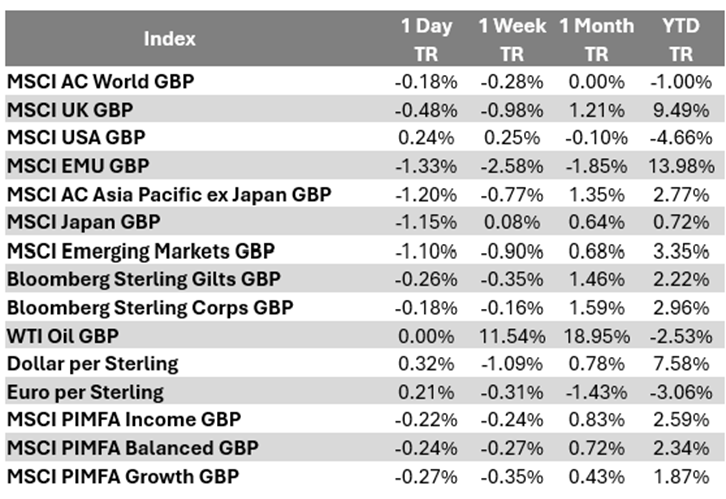

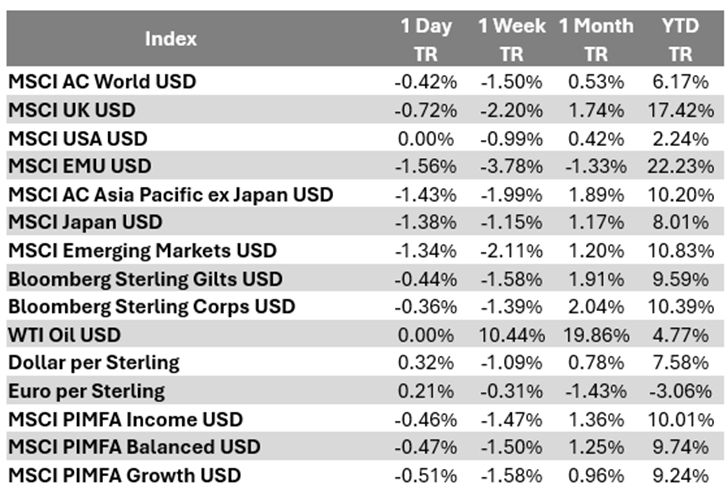

Bloomberg as at 20/06/2025. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

20/06/2025