Please see below the Daily Investment Bulletin from Brooks Macdonald, received on 26/09/2024:

What has happened

Equity markets looked to be running out of steam for the most part yesterday. That changed however when, after hours, US semi-conductor manufacturer Micron Technology published better-than-expected results. The Micron news fired-up after-hours equity futures markets and has fed through into better equity market performance overnight in Asia and also coming into this morning in Europe.

UK gets an OECD growth upgrade

Yesterday saw a decent upgrade to the UK’s economic growth outlook from the ‘Organization for Economic Co-operation and Development’ (OECD). In its latest global economic outlook, the OECD now sees UK real (constant prices) Gross Domestic Product (GDP) calendar-year growth at +1.1% this year, followed by +1.2% in 2025 (and up from old estimates of +0.4% and +1.0% respectively previously back in May). The cumulative size of the OECD upgrade to their UK outlook over the next two years is the most of any G7 (Group-of-7 advanced economies) country.

Sabre-rattling

Investors were reminded that geopolitical risk continues to stalk markets – China yesterday launched an InterContinental Ballistic Missile (ICBM) test into the Pacific Ocean, its first public test of such a missile in international air space in over 44 years, since May 1980. Designed to carry a nuclear payload, a US Pentagon spokesperson later said the US had been given “some advanced notification” by China. The timing of the launch, signalling China’s modernisation of its nuclear capability, was thought to intentionally coincide with the start of the latest UN General Assembly meeting, and ahead of a planned telephone call between China and US presidents Xi and Biden expected in the coming weeks.

What does Brooks Macdonald think

The flipside to the OECD’s better UK economic growth outlook yesterday was stickier inflation pressures. The OECD forecasts UK core inflation (excluding energy and food prices) running at +3.7% this year, and +2.8% next (up from +3.3% and +2.5% respectively back at its May estimates). Those price pressures underscore why the Bank of England has been at pains lately to signal that it will need to move somewhat cautiously on any further interest rate cuts over the coming months.

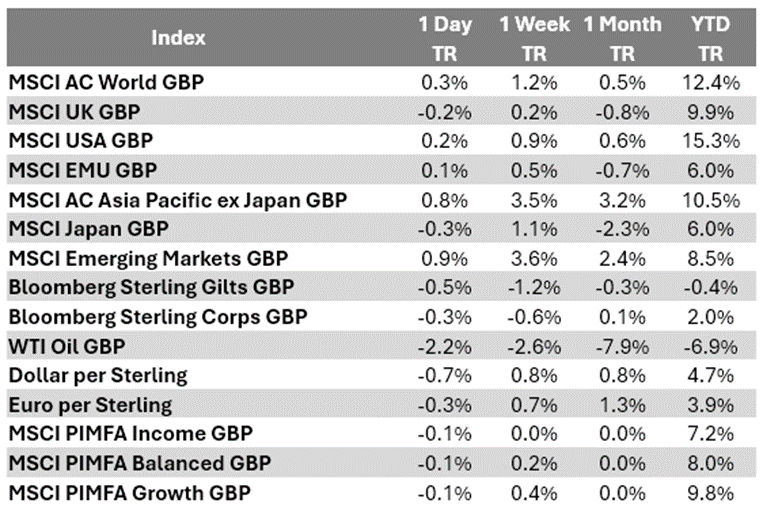

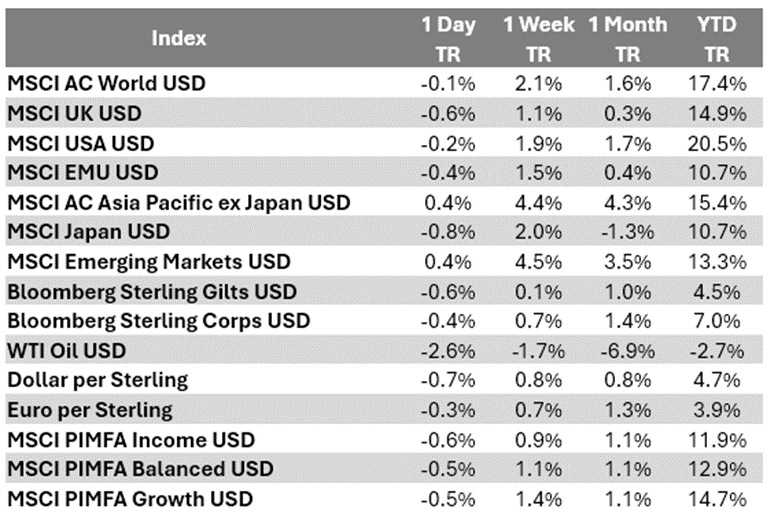

Bloomberg as at 26/09/2024. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Charlotte Clarke

26/09/2024