Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 13/01/2026.

An uncertain world for investors

Geopolitical tensions, weak U.S. jobs data, and silver supply restrictions shake markets.

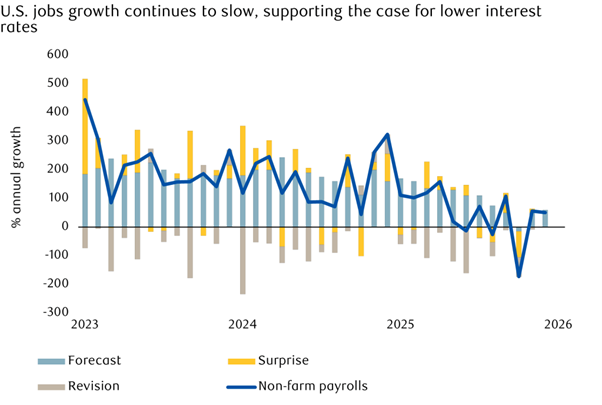

U.S. jobs growth disappoints

Most of last week was dominated by geopolitical news related to the U.S. and China, but the week ended with the U.S. non-farm employment report. This was being closely watched because a strong report would reduce the rationale for interest rate cuts and could imperil the strong equity market performance.

Jobs growth in December was slightly below expectations, but the most eye-catching figures were the revisions to November’s numbers. Non-farm employment has failed to return to its previous peak since November, which was affected by the U.S. government shutdown. The unemployment rate declined, but if jobs growth is low or even negative, the Federal Reserve (the Fed) will be keen to cut interest rates and may possibly do so sometime in the second quarter.

Source: LSEG Datastream

The ‘Donroe’ doctrine

Former U.S. President James Monroe believed that any external power’s interference in the politics of the United States should be treated as a hostile act. This principle has been cited as the rationale for the indictment, extraction and pending prosecution of Venezuelan President Nicolás Maduro and his wife. The accusation? Facilitating the transit of narcotics into the U.S. as an act of narco-terrorism.

The extraction only had a modest impact on major markets. Few mainstream leaders express any sympathy for President Maduro, whose position was widely considered illegitimate anyway. Once a rich country, Venezuela now has minimal impact on economic growth and has been a bond market pariah for many years.

Despite having the largest proven oil reserves in the world, Venezuela’s current production is marginal, with extraction and transport infrastructure having fallen into disrepair, particularly following their nationalisation under former President Hugo Chavez (which contributed towards the country’s growing reliance on narcotics as a source of revenue).

There’s scope for a huge increase in Venezuelan oil production of hundreds of thousands of barrels per day this year, and potentially a few million barrels per day in future years. This stretched timescale made no immediate impact on the oil price this week, but some oil stocks did benefit.

Chevron has production in Venezuela and is therefore best placed to extract and transport oil from the region. Exxon Mobil and ConocoPhillips hold legal claims on Venezuela, which could now be satisfied. Other perceived beneficiaries included those refining companies that have capacity on the U.S. Gulf Coast. Crude oil comes in various flavours, and the Gulf Coast refineries are configured to use heavy crude oil, such as that which comes from Venezuela, which is quite different from the light oil the U.S. produces.

President Donald Trump’s plan for a U.S.-led revival of Venezuela’s oil industry would be a years-long process, which could potentially cost upwards of $100 billion and create opportunities for oil services businesses such as Halliburton and Baker Hughes.

However, it’s important to recognise that despite the ousting of President Maduro, Venezuela retains a deeply entrenched criminalised state structure, which needs to be displaced to encourage the kind of investment that brings oil output up to potential.

Aside from addressing narco-terrorism and increasing access to heavy crude oil, the intervention in Venezuela expanded U.S. influence over the region, which has been courted over many years as a source of mineral resources for China. Under U.S. sanctions, China had become the marginal buyer of Venezuelan crude oil, a supply that’s now being redirected towards the U.S.

President Trump and his administration have also expressed determination to acquire Greenland, another mineral-rich region that has a strategic geographical value. The White House Press Secretary’s statement that “utilising the U.S. military is always an option” supports the idea that countries will need to invest in their domestic productive capability and seek to diversify their financial assets to reduce risk during a period of geopolitical decoupling.

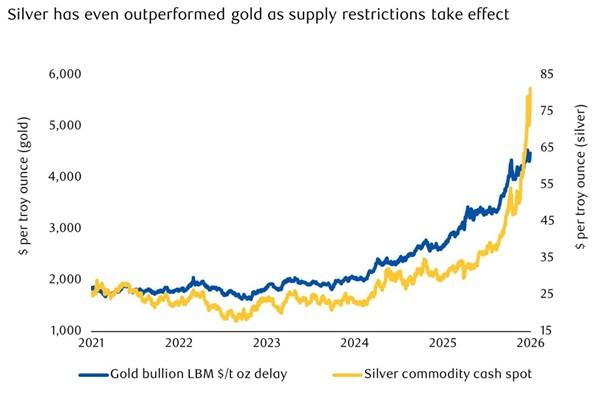

Going for silver

Another prescient illustration of China and America’s resource rivalry comes in silver; China announced at the start of the year that it would restrict exports.

Silver normally trades like a particularly volatile precious metal but has more recently begun to be considered a critical industrial metal. China is the second biggest miner of silver, but by far the biggest refiner of silver. Silver can now only be exported from China with government permission. It’s not banning exports, but rather adjusting the speed of licensing as a tool with which to manipulate global supply chains. Western silver consumers are moving to secure supply.

China is reliant upon imports of silver ores from Peru and Mexico, which other consumers are now understandably keen to intercept. China cannot permanently restrict the silver market as its share of mined silver is too low, but it can cause a medium-term bottleneck while sourcing, verifying and refining capacity catches up in other regions.

Source: LSEG Datastream

In the meantime, the silver market remains under acute strain, with critically low inventories across key hubs colliding with heavy speculative demand, notably from Chinese retail investors. It means that paradoxically, despite the export restrictions, silver is actually more expensive in China than in the West.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

14/01/2026