Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 09/12/2025.

Markets await key interest rate decisions

Bonds started the week slightly on the back foot as markets await the interest rate decisions of three central banks.

Key highlights

- U.S. interest rates to be cut? Weakness in the U.S. jobs market fuels bets on a Fed rate cut this week.

- The race for the Fed chair: Kevin Hassett emerges as frontrunner for Fed chair, but his White House ties spark independence concerns.

- Germany’s pension showdown: The German coalition government passed its pension bill despite a rebellion by 18 younger members of Chancellor Friedrich Merz’s own party.

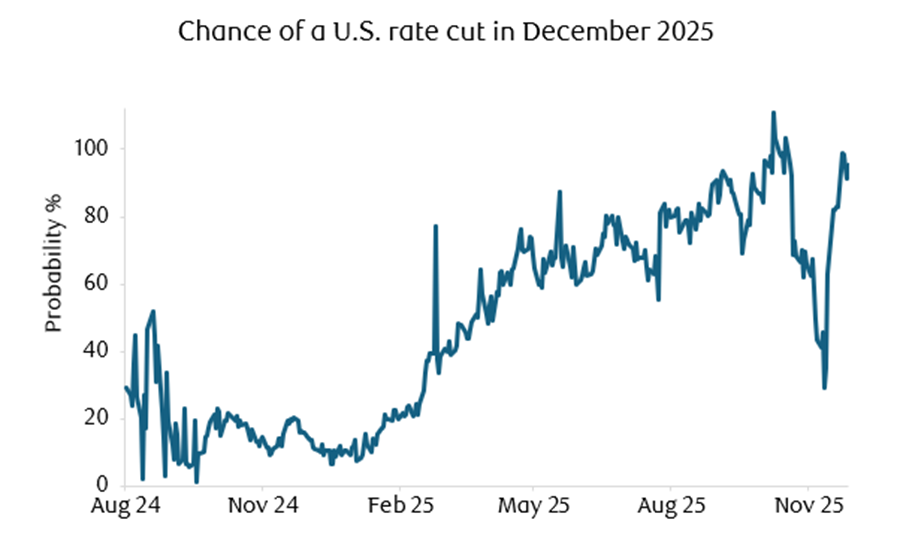

Federal Reserve rate cut expectations

Source: Bloomberg

U.S. investors returned from their Thanksgiving holidays with a focus on this week’s Federal Reserve (the Fed) interest rate decision. Bets on a rate cut have been bolstered by tentative evidence of job market weakness. The official non-farm payrolls report for November wasn’t released on Friday as the Bureau of Labor Statistics is still catching up from the government shutdown. In its stead, evidence has had to come from private sector studies, like the ADP Employment Report and the Challenger Report.

The S&P 500 has been hovering near all-time highs but struggling to gain significant traction. It has benefitted from the anticipation of lower interest rates and most investors expecting slower jobs growth. Meanwhile, other risk assets have found the going harder.

Cryptocurrencies recovered a little after their precipitous falls during October and November. The more conventional limited supply asset, gold, recovered much sooner and continued that recovery last week.

In the aftermath of the UK Autumn Budget, gilts and the pound have broadly held on to their gains, outperforming most other government bond markets. The exception would be Japanese government bonds (JGBs), whose yields have continued to rise, bucking the trends of other government bond markets. Thirty-year JGBs have fallen in price by about 20% this year.rowth-supportive loosening of policy in the near term, the package announced also included measures which the OBR estimates will reduce Consumer Price Index (CPI) inflation by 0.5% in Q2 2026. This includes freezing rail fares, extending the fuel duty freeze, and an energy bills package that aims to reduce bills by an average of £150 per year from April 2026.

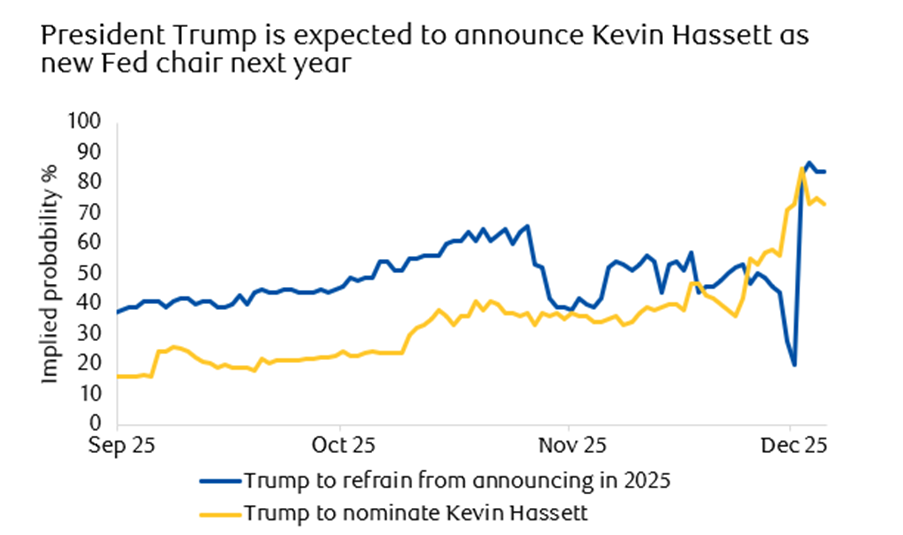

Race for the Fed chair heats up

Source: Bloomberg

Speculation remains rife about who will succeed Jay Powell as the next Fed chairman, with the prediction markets now firmly favouring Kevin Hasset.

As director of the National Economic Council, Hassett forms part of the White House economic team. While this demonstrates his suitability based on knowledge and experience, it also raises questions over his independence. Those questions are added to by his recent assertions that the Fed should be cutting interest rates more, a view shared with President Donald Trump.

Hassett’s also likely to be remembered for his co-authorship of the infamous Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market. The book, published in October 1999, argued that the Dow Jones Industrial Average would triple in value over the coming two to four years – however, over that time period, it barely grew and was at one stage 30% down.

The prediction markets indicate that Hassett is the frontrunner, but that he’s unlikely to be named as Powell’s successor until next year or assume the position until May 2026. He would be joining a Fed that has historically operated by consensus but has recently become more divided – this is due to the injection of Stephen Miran as a governor, who joined directly from the White House alongside two more explicitly dovish Fed members.

By May, the Supreme Court will likely have ruled whether President Trump could fire Fed Governor Lisa Cook. If the court rules in the president’s favour, he would be able to name a third governor and increase his influence on the committee, although probably not decisively.

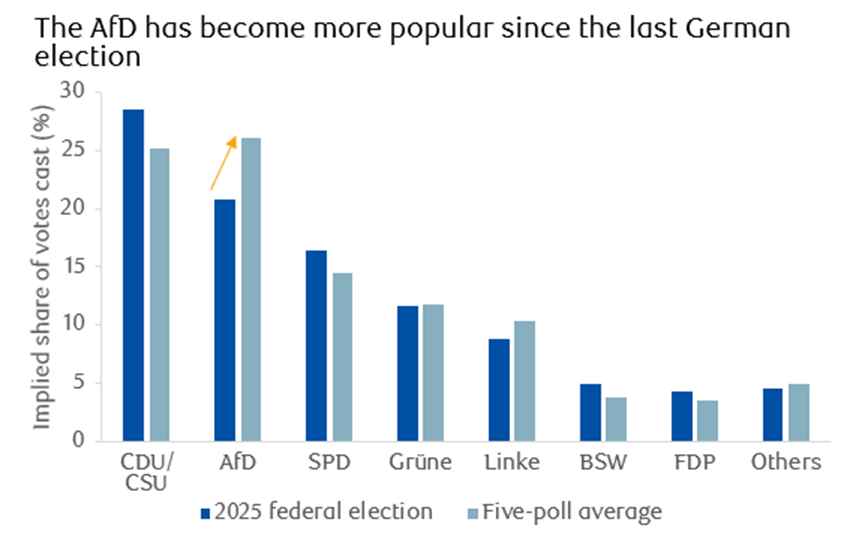

Pensions threat to German defence spending

Source: RBC Brewin Dolphin

In Germany, Fredrich Merz’s coalition government passed its pension bill. This was achieved despite a rebellion by 18 younger members of his own party, who argued that the increased spending was shifting the burden of pensions spending to future generations.

This example of politics reflecting intergenerational interests threatened to derail one of the policies the Social Democratic Party had brought to the coalition. Had it failed, the coalition may have collapsed, raising the prospect of further elections. Current polling indicates the right-wing Alternative for Germany (AfD) party might attract the most votes, which would have made it harder still to exclude it from government.

The AfD is less keen to loosen Germany’s restrictive debt break policy and increase defence investment. However, even though the AfD’s popularity has continued to grow, its path to power still seems elusive. It’s currently only the second largest party, with no new elections due until 2029. If the collapse of the coalition triggered new elections, AfD still seems short of a majority, and would likely be excluded from government by the other major parties.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

10/12/2025