Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 25/11/2025.

Stocks rebound despite AI bubble concerns

Markets responded positively to new AI applications and tech firm earnings results following last week’s performance slump.

Key highlights

- Artificial intelligence (AI) bubble concerns grow: Nvidia’s earnings report impressed, but valuation concerns dominate sentiment.

- Foggy view of U.S. data: Markets think a December interest rate cut is less likely, as limited data visibility favours a pause.

- Nerves ahead of the Autumn Budget: Weak UK economic data lays bare the challenging backdrop that’s confronting the chancellor.

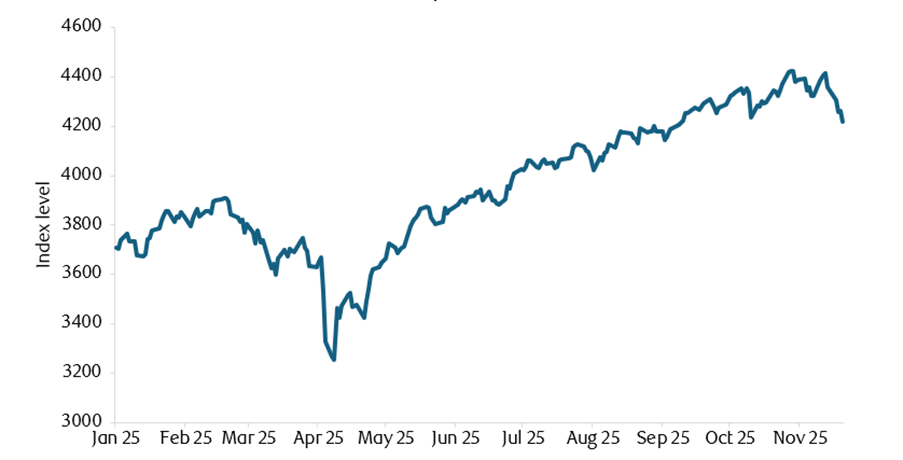

Markets hit a wall last week

Markets traded with a more cautious undertone last week, as concerns around stretched AI valuations linger despite Nvidia once again reporting an outstanding quarter. U.S. economic data provided little clarity ahead of the December Federal Reserve (the Fed) meeting, while UK indicators weakened further ahead of this week’s Autumn Budget.

Let’s kick off with AI, and markets were nervous ahead of the highly anticipated Nvidia earnings results on Wednesday.

As the poster child and arguably one of the biggest beneficiaries of AI, Nvidia is in a position to make or break the AI enthusiasm that has propelled global stock markets to record highs this year. But it once again beat high expectations and delivered a stellar report card. Revenue increased 62% year-on-year (YoY), and earnings per share surged 67% YoY against a tremendous base, both handily above expectations.

In terms of outlook, Nvidia highlighted continuously strong demand for AI data centres, high utilisation rates, and continued momentum in new platform deployment. CEO Jensen Huang said demand for Blackwell (its top AI chip infrastructure) is “off the charts”. Broader integration across software and networking reaffirms Nvidia’s competitive advantage. As a result of its moat (its long-term competitive advantage), the business is highly profitable, with an impressive 75% gross margin guided for Q4 2025, despite the surging cost of memory chips.

MSCI World Index showed a decline in performance

Source: Bloomberg

However, market reactions show sentiment has turned fragile on AI. Nvidia and the broader AI-related stocks initially rallied but reversed intraday to end the session lower. With Nvidia now comprising around 8% of the S&P 500 index, its price movement has a significant influence on the broader market. This behaviour suggests even companies with exceptionally strong fundamentals and growth prospects face a valuation reality check. It could simply come down to investors taking profits before year-end across a sector that has performed so well.

It’s too early to say that the AI rally is over, but we’re entering a stage where investors are putting more scrutiny on aspects such as return on investments and valuations.

The long-term AI opportunity remains intact. Demand for compute capacity (the total amount of computing resources available to process data), infrastructure upgrades and AI adoption continues to accelerate. However, the market discussion has shifted from pure growth momentum to valuation and over-investment risks.

While we believe that AI will be a transformative technology, there are lingering questions about whether the returns generated by providers of AI services will be high enough to justify both the massive levels of investment, and the extended valuations the AI picks and shovels plays trade on. In addition, the S&P 500, excluding the so-called ‘Magnificent Seven’, also trades on a large price-to-earnings premium compared to the World ex U.S. market. Therefore, we hold a neutral view of U.S. stocks for now.

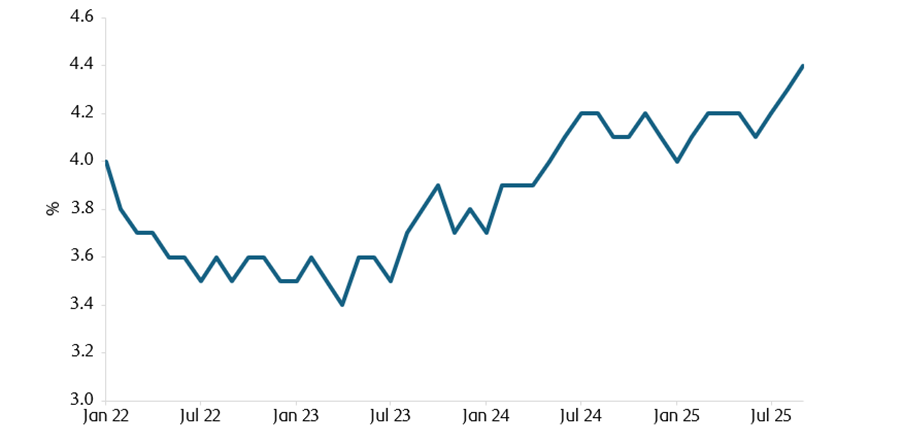

The U.S. unemployment rate rose

Another highly anticipated event last week was the release of the September U.S. employment report, which was significantly delayed due to the U.S. government shutdown.

The report showed 119,000 new jobs were created over the month, well above the 51,000 expected. However, the unemployment rate edged higher from 4.3% to 4.4%. This was the third consecutive monthly increase, defying expectations of no change. This is likely to add to the dovish view within the Fed.

U.S. unemployment rose to 4.4%

Source: Bloomberg

However, the Fed will not receive another jobs report before its December meeting, and visibility on inflation data is expected to remain more limited than usual due to the previous government shutdown. With the labour market a bit weaker (but still generating jobs), and conditions not deteriorating sharply, most investors now view a Fed pause in December as the most appropriate and likely scenario.

Markets have reduced expectations for a December interest rate cut, and further policy easing is considered more likely from 2026 if inflation and growth slow.

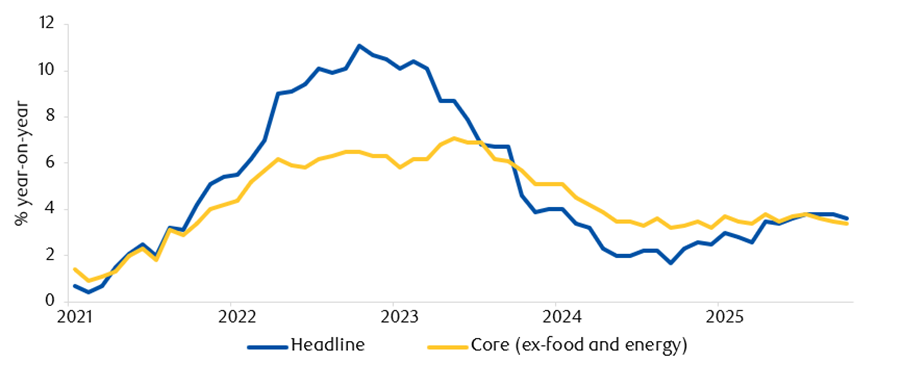

Economic trouble for the chancellor

In the UK, the data flow remained weak ahead of this week’s Autumn Budget. October retail sales fell by 1.1%, while the private sector business survey (PMI) suggested the economy was stagnant. Fiscal indicators have deteriorated, with the fiscal deficit widening more than expected in October.

This is an economic backdrop that makes it hard to raise taxes without further dampening growth, but it’s widely speculated that this is what Chancellor Rachel Reeves will do.

One silver lining is that inflation is heading in the right direction, albeit slowly. Headline UK CPI (Consumer Price Index) slowed from 3.8% to 3.6% while core inflation slowed from 3.5% to 3.4% in October. Services inflation, which is closely monitored by the Bank of England (BoE) as a measure of domestic price pressure, softened from 4.7% to 4.5%, falling below expectations.

The UK Consumer Price index slowed to 3.6%

Source: Bloomberg

A lower inflation trajectory helps support the case for a rate cut in December. Markets are pricing in a very high chance of that happening. Ultimately, whether the BoE will proceed with that depends on Governor Andrew Bailey’s swing vote. The latest inflation figure probably ticked a box, but we still need to see how the Budget goes.

Overall, last week’s market action reflected a more cautious stance. AI remains the dominant structural theme, but greater scrutiny is being applied now, so the bar for a further rally is high at this stage.

In the U.S., job growth continues, but there are signs of cooling. In the UK, data confirms a weakening backdrop ahead of significant fiscal decisions that ultimately impact growth.

Staying diversified remains highly relevant in this environment.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

26/11/2025