Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 14/10/2025.

What’s behind the latest U.S. stock sell-off?

Key highlights

- Stocks rally on Takaichi win: Japanese stocks got off to a flying start after Sanae Takaichi was announced leader of the Liberal Democratic Party.

- Why are long-term bond yields rising? Inflationary pressures returning, a lack of fiscal restraint, and rising gold prices have seen global long-term bond yields rise.

- The risk of a circular AI investment model: The adoption of a ‘vendor financing’ model could see companies misjudge the underlying demand that the system’s built on, potentially leading to a depreciation in asset value.

Stocks buffeted by political waves

Stocks fell sharply on Friday, driven by concerns of a renewed U.S.-China trade war. The initial action came last Thursday, with China raising export controls on rare earths (metallic elements found throughout the Earth’s crust), which is assumed to be in retaliation against U.S. technology curbs. China also imposed special port fees on U.S. vessels docking at Chinese ports, and an anti-trust investigation into U.S. semiconductor manufacturer Qualcomm.

President Donald Trump announced he would respond with a new 100% tariff on Chinese imports, which was to be imposed over and above all pre-existing tariffs. These latest measures prompted the biggest U.S. equity sell-off since April. It was led by technology companies, which risk being caught in the political crossfire of the dispute and face their own investment controversies, as we discuss later.

Sunday saw some remarks by President Trump and Vice President JD Vance that are being treated as evidence that the TACO (Trump Always Chickens Out) heuristic remains in play. The implication is that a violent market reaction makes the administration reverse or delay its measures. But did the White House promise anything like that? Not really.

The president just emphasised that he thinks it won’t be a problem, and that the U.S. and China aren’t trying to impose pain on each other. At the time of writing, the dispute has yet to be resolved.

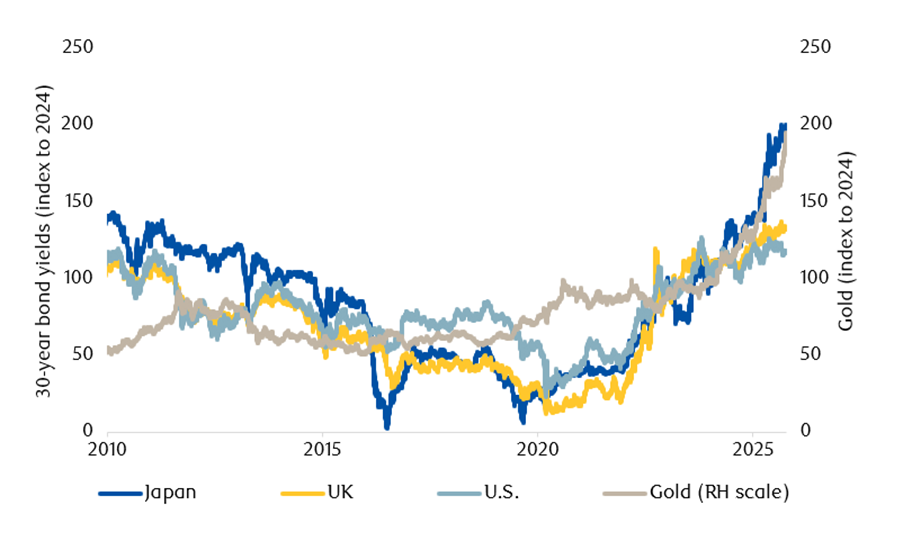

Bond yields and gold have risen as governments become more wasteful

Source: LSEG Datastream

Japanese stocks got off to a flying start last week following the surprise result of the Liberal Democratic Party (LDP)’s leadership election.

Sanae Takaichi emerged as the winner, causing ructions in financial markets due to her previous statements on the best course for monetary and fiscal policy. Takaichi is considered a dove on both fronts – advocating for tax cuts and opposing interest rate increases.

Government intervention into monetary policy has been a bit of a theme since U.S. President Donald Trump’s return to power. He’s locked horns with his previous appointment to the Federal Reserve (the Fed), Chair Jay Powell, and more recently with Fed Governor Lisa Cook. The Japanese government has also attempted to steer policy before, but previous efforts were rebuffed by the Bank of Japan (BoJ) board.

The reaction was a fall in the yen and consequent rise in equities. The bond market’s response was more nuanced. Shorter-dated bonds saw gains (yields fell) as it seems less likely that interest rates will go up in the short term due to Takaichi’s perceived political pressure. However, longer-dated bonds weakened (yields rose) because a more accommodating fiscal attitude means higher inflation and more bond issuance.

These reactions did partially reverse toward the end of the week as the early challenges of Takaichi’s prospective premiership emerged. She and her government need to gain parliamentary support, but the LDP-led coalition doesn’t have a majority in either of the two chambers of the Japanese National Diet.

To compound these challenges, the junior coalition party, Komeito, threatened to leave the coalition (which has broadly endured since 1999) due to differences with Takaichi. This prompted anxieties over whether a budget could be passed and what it would contain. However, it still seems likely that Takaichi will be able to form a government, and pass a budget, with opposition more likely to be directed at looser fiscal policy, rather than tighter.

The direction of monetary policy is harder to call. For the time being, neither the BoJ nor the government seem inclined to raise interest rates. They are concerned about weak wage growth due to a lack of profitability when the spring Shunto wage negotiations begin.

Why are long-term bond yields rising?

The rise in long-dated bond yields is part of a trend we’ve seen in other countries. The UK has suffered from them, as has the U.S., and the change is particularly pronounced in Japan (because rates are rising from such a low level).

It’s not a coincidence that long-term bond yields have risen, as inflationary pressures return from deglobalisation and a lack of fiscal restraint at the same time as gold prices have risen. Notably, each phase of bond market weakness (first in the UK, then the U.S., and now Japan) has been accompanied by an increase in gold prices.

The pace of gains naturally raises the question of whether gold has entered a bubble. With no valuation metric or yield, it’s impossible to definitively rule it out. However, the news flow remains supportive of gold, with little prospect of that changing.

What could change it? One possibility is a bond market riot forcing a return to fiscal restraint. Another is the natural cycle of any bull market – peaking when there are no prospective buyers left. For now, however, it seems there are still plenty of potential new buyers for gold.

Why AI’s circular investment environment is risky

Concerns of a bubble have also infected the artificial intelligence (AI) ecosystem.

For many years, the biggest players in AI have been the hyper-scalers, which generate enormous cashflows and have been well placed to funnel some of that funding back into building out cloud capacity. But over time, other players have also risen in prominence and have contributed to financing increasing investment into the IT and AI space.

However, over the last couple of years, the means of funding new investment has switched from customers paying suppliers, to more novel mechanisms of circular investments. These sometimes-complex transactions involve technology suppliers – primarily semiconductor manufacturers and cloud providers – taking equity stakes, providing capacity guarantees, or offering debt to secure long-term procurement commitments from AI developers and infrastructure tenants. These tenants can be individual customers or organisations within a larger, shared infrastructure.

This ‘vendor financing’ model helps share the risk of the colossal capital expenditure required for some AI infrastructure suppliers. However, it can also flatter the reported revenue and subsequent market valuations of the suppliers – establishing a potent, self-reinforcing cycle.

NVIDIA has been leading in this space by actively guaranteeing customer demand through direct equity investments and capacity backstop agreements. The company has enjoyed enormous cashflows in recent years and is now using them to create its own demand for the future. NVIDIA reached an agreement for CoreWeave to buy its chips, committing to buy any excess cloud capacity that CoreWeave has available.

A commitment from such a financially robust counterparty serves as security against CoreWeave’s own borrowing. NVIDIA also committed to invest up to $100 billion in OpenAI, on the condition that NVIDIA systems power 10 gigawatts (GW) of capacity.

There are reasons to be cautious about these arrangements. Firstly, the fact that so much investment is taking place raises fears of previous over-investment cycles. Most companies investing $5 billion today will be suffering a $1 billion depreciation charge next year. If demand doesn’t meet expectations, there could be a further write-down charge.

The very clear and present demand for these relatively short-lived assets has underpinned the investment case to date. But as the circular commitments become more prevalent, there’s a risk that the companies fundamentally misjudge the underlying demand on which the system is built.

That risk seems modest right now, but it’s one that needs to be monitored closely.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

15/10/2025