Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 23/09/2025.

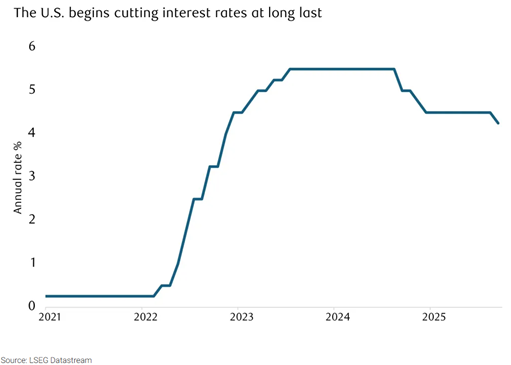

The current state of interest rates

Stocks generally rose over the week to Friday.

Changes to interest rates were largely anticipated, with a cut to U.S. rates and holds in Japan and the UK. Markets are currently anticipating the U.S. will face more rate cuts than the UK and Europe. Interest rates should still rise in Japan, but very slowly.

The main headlines were captured by the slowing of the UK’s quantitative tightening programme. This means that the government’s sale of bonds will slow, which will provide some relief, as it needs to find buyers for substantial bond sales over the coming months.

However, maintaining the stock of bonds for longer will now cost the Treasury, as it must ultimately foot the bill for differences between the returns being made on purchased bonds (at old historically low rates) and the interest rate paid on the reserves used to fund such purchases (at more recent, higher rates).

Currently, markets expect interest rates to remain within a corridor of stability; loose enough in the Eurozone and getting looser in the U.S., but with neither region threatened by an imminent recession.

The current environment could be described as a ‘Goldilocks’ environment where growth is weak enough (and inflation isn’t too high) to allow the Federal Reserve to cut interest rates.

Technology drives equity returns

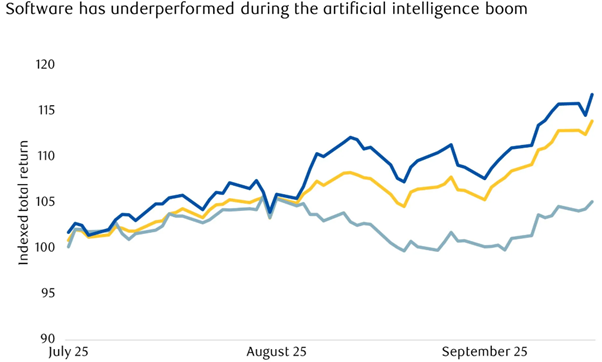

Contributors to global equity market returns have broadened out, but technology remains a significant driver. Within the technology sector, we’ve seen some dispersion of returns.

Artificial intelligence (AI)-related stocks have been strong performers, but resolving which companies are benefitting from AI and which are threatened remains a source of controversy for the market.

For example, the rise of AI has raised concerns about competition from lower-cost, AI-driven research tools – which could potentially disrupt the business models of companies that provide market insights, research, and strategic frameworks, such as Gartner. In August, Gartner’s stock plummeted by as much as 40% after the company reported a slowdown in growth, citing weaker demand for IT advisory subscriptions and reduced value of federal contracts.

However, not all research companies are suffering. RELX, for example, has seen growth in its scientific, technical and medical (STM), legal and risk segments, thanks in part to the benefits of AI. The company’s ownership of copyright and its control over how its articles are used have allowed it to provide embedded AI tools to researchers, making them more productive.

While AI may have driven strong returns from the technology sector overall, many software companies have started to see it as more of a threat. One of the primary reasons for this is the changing spending environment in the tech industry. Already limited IT budgets now needing to incorporate AI spending has resulted in a decrease in spending on traditional software solutions.

The poor spending environment, combined with the rise of AI and the emergence of new technologies like vibe coding (coding using natural language prompts and AI), has led to concerns that traditional applications will be replaced.

A winning model

Companies with user-based revenue models (where the amount you pay is dependent on how many users are accessing the product or service), such as Adobe, are feeling the most pain. They face competition from lower-cost alternatives and struggle to maintain premium price points.

In contrast, services that are sold on a usage basis (rather than per user), such as cloud or database services, have been prospering. They require less commitment from customers, and their costs tends to be more related to their value, making them well-suited to the field of AI, where demand is difficult to forecast. Providers of this type of service are benefitting from the capital spending on AI from startups.

Microsoft and Palantir are two exceptions to this. Microsoft has a so-called ‘seat-based’ business (a pricing model where customers pay for individual licenses, or ‘seats’, that grant them access to a software or service). However, this forms part of a much more complete business that extends beyond software into infrastructure through its Azure cloud computing platform. This leaves it well positioned to benefit from AI adoption.

Historically, Microsoft’s Office package has been difficult to disrupt and its barriers to competitors remain robust. However, over the summer, Elon Musk announced that he would launch Macrohard to rival Microsoft. It will do this by using a fleet of specialised AI agents to handle all aspects of software development, including code generation, testing, and management. Although Musk is a formidable challenger, Microsoft has shown itself to be agile enough to meet such challenges in the past.

Ultimately, the future success of software vendors will depend on their ability to expand their existing customer base and adapt to changing user behaviours. Companies with strong research and development capabilities, and products that can fit around evolving user needs, will be better positioned for growth.

While this is theoretical, it highlights the importance of infrastructure players and the challenges faced by application vendors in the current software landscape. The emergence of Macrohard and other AI-powered initiatives will only add to the complexity and uncertainty of the software market, making it essential for companies to stay ahead of the curve and innovate to remain relevant.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Andrew Lloyd

24/09/2025