Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 12/08/2025.

UK cuts interest rates – will the U.S. be next?

Janet Mui, Head of Market Analysis, and Guy Foster, Chief Strategist discuss the U.S. markets’ strong earnings season, President Trump’s 100% tariffs on semiconductor imports, and interest rate cuts in the UK.

Key highlights

- Trump appoints Fed Governor: : President Trump has appointed Stephen Miran temporary Governor of the Federal Reserve. Governor Miran is expected to vote for lower interest rates whenever possible.

- Bank of England cuts rates: The central bank voted to cut interest rates by 0.25% last week. A further rate cut in September now seems much less likely.

- UK inflation expectations rise: UK consumers are expecting inflation to rise as services prices are driven upward by higher wage growth.

The Trump administration breaches the Fed

Last week was another busy one for President Donald Trump. He recently found himself in need of a new Federal Reserve (the Fed) Governor after Adriana Kugler surprisingly stepped down early from her post. The president could have left the seat open if he wanted to ponder the decision longer; however, he chose instead to make a temporary appointment of Stephen Miran, who will serve until January.

Miran is well-qualified for the job. He is a Harvard Economics PhD, and a former economic adviser to the U.S. Treasury. He spent a short spell working as a strategist for a fund manager before taking up the role of chair of the Council of Economic Advisers, which operates like an economic think tank for the president.

While at Hudson Bay Capital, Miran wrote what became his magnum opus, a document called ‘A User’s Guide to Restructuring the Global Trading System’.

The document has never been directly embraced as Trump policy, but it’s one of the most controversial potential directions that the administration could take. This is because it discusses a ‘user charge’ imposed on U.S. dollar holders, with the aim of discouraging them to hold other assets. This would facilitate a devaluation of the dollar, making U.S. imports less competitive and, in turn, threaten to force reserve holdings into non-dollar markets.

This would complicate trade that takes place in the dollar and would raise borrowing costs for the U.S. (which has traditionally been funded by the recycling of global savings into U.S. Treasuries).

As mentioned, the guide was never embraced by the administration but the ‘dollar user charge’ had parallels with section 899 of the One Big Beautiful Bill Act. The latter sought to punish companies for having their own punitive (“unfair”, in the words of the authors) taxes. This was far narrower in scope than the ‘user charge’, but the punishment would be a tax on interest, which seemed similar.

Ultimately, Treasury Secretary Scott Bessent managed to get the section dropped from the bill to the relief of foreign investors. This seemed to demonstrate that Bessent, as much as anyone, has the president’s ear when setting economic policy.

It seems clear that Miran will play the role of administration stooge and vote for lower rates wherever possible. This may seem more impactful than it actually is. The Fed was probably going to cut rates next month anyway, following the recently discussed weaker payroll numbers. So, Miran will be swimming with the tide initially at least.

In subsequent meetings, he could become a dovish dissenter. By convention, there’s relatively little dissent on the Federal Reserve Open Markets Committee, with the Committee typically reaching a consensus and then voting it through largely unanimously.

Source: LSEG

The Bank of England cuts rates

Dissent is much more encouraged on the Bank of England (BoE)’s Monetary Policy Committee (MPC). Indeed, the August meeting saw an unprecedented stalemate, which required a second vote. In the end, five members voted in favour of cutting interest rates by a quarter of a percentage point after one member eased back from his original preference for a half percentage point cut. The voting made it seem quite a dovish meeting but in fact, the trajectory of interest rates has risen since the meeting. It now seems much less likely that we get a further rate cut in September, and it’s touch-and-go whether we get another during 2025 at all.

This was communicated through the accompanying statement (which talked about upside risk around inflationary pressures), subsequent comments from the governor (which described the decision as finely balanced), and the BoE’s forecasts (which show inflation peaking later, and higher, than previously). To be clear, BoE Governor Andrew Bailey confirmed he believes the direction of rates remains lower, but he wouldn’t be drawn on the timing.

Gilts have been in a holding pattern all year. It seems likely that their yields will fall, reflecting strong performance and lower interest rate expectations.

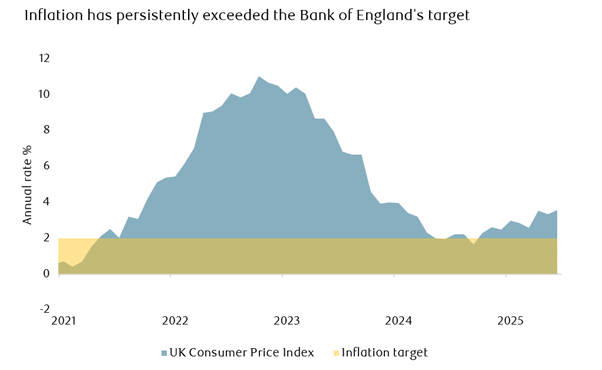

However, the MPC’s caution is understandable, because right now the case for further easing is far from conclusive. Inflation is above target. The energy cost increase is largely to blame but services prices, driven by higher wage growth, are a material and concerning factor. Employees have been keen to demand higher wages to reclaim their lost purchasing power following a couple of years of sharp price increases, which is reflected in elevated consumer inflation expectations. The BoE must feel compelled to try and redress that balance – inflation has spent just one month below target since May 2021 and has been more than double the target since.

The MPC’s conviction that rates will come down further will be based on the sensible assumption that as the labour market weakens, wage growth will follow, and as a consequence, consumer prices will rise more slowly.

UK government bonds remain attractive while the prospect of lower rates looms. Despite this, U.S. interest rate expectations fell faster than UK interest rate expectations last week, causing the pound to appreciate relative to the dollar.

Both the Fed and the BoE will be focused on whether forthcoming data suggests the labour market weakness is moderating or accelerating.

Source: LSEG

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

13/08/2025