Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 05/08/2025.

Expectations grow for a new U.S. rate cut

Janet Mui, Head of Market Analysis, discusses fresh U.S. jobs data and how this has raised expectations for a September rate cut. Plus, Guy Foster, Chief Strategist, explains how this data could affect the so-called term premium.

Key highlights

- ‘Liberation Day 2’: Stocks were bolstered following positive earnings reports last week.

- U.S. tariffs reintroduced: U.S. trade tariffs kicked back into effect last week, although many countries have negotiated reductions. As before, markets responded negatively.

- U.S. jobs data weak in July: the U.S. reported only 73,000 new jobs created last month. With continued job losses in manufacturing, and a significant downgrade to July’s report, the case for a rate cut was bolstered.

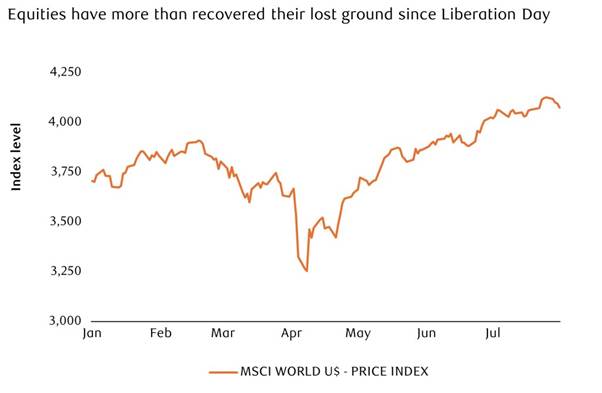

‘Liberation Day 2’

Source: LSEG

Stocks had a mixed run last week, supported by favourable earnings news while also plagued by concerns over the economic outlook. Two thirds of companies have now reported – including most of the mega-cap stocks, which have been driving the market in recent years. The obvious exception is Nvidia, which reports frustratingly late in the reporting season for such an influential company.

Technology and consumer discretionary stocks have been well received as the artificial intelligence (AI) theme remains at the forefront of investors’ minds. Some laggards, such as Apple and Alphabet, have shown renewed signs of life.

As the summer draws on, attention turns to what will drive markets next.

U.S. tariff measures are reintroduced

Three months have passed since U.S. President Donald Trump stood in the White House Rose Garden and announced a series of extremely punitive tariff rates on America’s trading partners. Back then, the market reaction was equally punitive, resulting in sharp declines in the dollar and U.S. equity and bond markets. His reversal of those measures caused a huge equity market recovery.

Last week, the measures were largely reintroduced, albeit with many countries having negotiated some form of reduction. The market reaction was, once again, negative as the measure took effect. Maybe there was still a lingering belief that the president would ‘chicken out’ and avoid raising tariffs, although it more likely reflects the impressive run that stocks have been on.

So far, the president has secured more than a trillion dollars of promised investment in the U.S. and imposed taxes of 15% on U.S. imports for most major importers. It seems like a phenomenal deal, though it will come at a cost.

Despite the conviction of Federal Reserve (the Fed) Governor Christopher Waller in lower rates, some element will inevitably be paid by U.S. consumers. So far, that has been modest. But the risk remains that companies have been reluctant to pass on costs while trade uncertainty remains, and that they’ve been able to avoid doing so while running down inventories.

Source: LSEG

U.S. interest rates are held

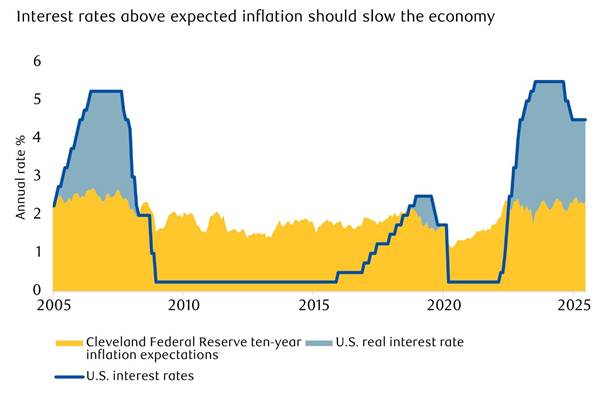

U.S. interest rates were kept on hold last week, but it wasn’t a unanimous decision, with two Federal Open Market Committee members dissenting for the first time since 1993. One of these was Michelle Bowman, who’s typically regarded as a relatively dovish member. The other was Waller, who has, at times, been relatively hawkish.

Cynics might say that Waller’s conviction in lower rates has to do with his possible nomination as the new chairman of the Fed. However, he attributes it to a belief that producers and importers will share the burden of tariffs, sparing consumers from the pain. That seems optimistic, but his belief that tariffs are a one-off adjustment and not an enduring inflationary influence is more credible.

Another observation from Waller was that monetary policy is tight, and the economy is slowing. ‘Real’ interest rates (interest rates adjusted for inflation) are still quite positive based on long-term inflation expectations.

Weak U.S. job market bolsters the case for a rate cut

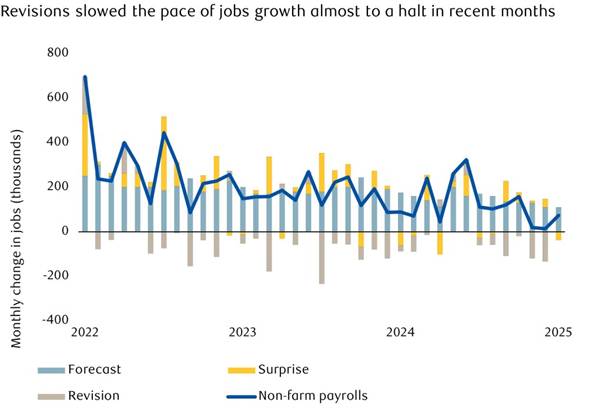

The evidence of a weakening labour market is pretty mixed, but one factor Waller points to is that in June, government employment offset weakness in private sector jobs growth, leaving the overall pace of jobs growth little changed.

As it happens, Friday’s jobs report showed private sector jobs growth rebounding slightly, but overall, it was still a weak report with just 73,000 new jobs created. Continued job losses in the manufacturing sector, and a significant downgrade to last month’s relatively upbeat report, bolstered the case for a rate cut.

Source: LSEG

Source: LSEG

Jobless claims reported last week remained close to their lows for the year. Job openings fell earlier in the week, but they still remain at a high level compared to previous cycles, and the Employment Cost Index continued to rise at a historically fast pace. This index is the best measure of the total pay and benefits accruing to employees, and its growth reflects their ability to achieve better compensation.

Overall, Waller will feel vindicated by the jobless claims, but the other data makes it understandable that his colleagues wanted to sit on their hands.

However, the most striking thing about this data release was that although it seemed to strengthen the case for an interest rate cut, which President Trump has been calling for, the president himself rejected the release as rigged for political purposes and promptly fired the head of the Bureau of Labour Statistics, which compiles the numbers. This is an extraordinary move and one that further weakens the credibility of U.S. institutions.

Taken together, these factors are likely to add to the so-called term premium, which investors need to lend to the U.S. Bond yields are the government’s borrowing costs. They are determined by investors’ expectations of interest rates over the life of a bond, plus an additional amount to cover uncertainty about that path of interest rates. This extra amount is called the term premium.

Perhaps the final measure landing last week, which the Fed will keep a close eye on, was its preferred measure of inflation, the Personal Consumption Expenditure price index. Its 2.6% rise (with core prices rising by 2.8%) suggests that inflation remains above target and has been rising at a time of political pressure, when some financial indicators suggest the economy is slowing.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

06/08/2025