Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 22/07/2025.

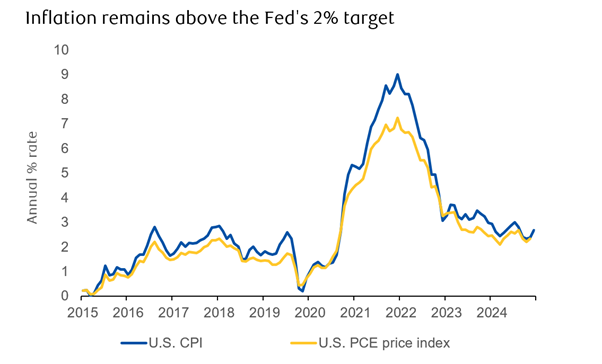

U.S. inflation remains contained

U.S. core inflation has only been modestly impacted by tariffs so far, rising marginally month-on-month in June.

Key highlights

- Boost for cryptocurrencies: U.S. Congress passed legislation to regulate stablecoins, paving the way for the potential broader use of cryptocurrencies.

- Tariff costs and consumer price increases: the full impact of tariffs will unfold slowly, making it much harder for consumers to associate their loss of disposable income with tariff increases.

- Rumours continue around Federal Reserve Chair’s departure: frontrunners to replace Jerome Powell include President Trump’s economic adviser Kevin Hassett, and former Fed governor Kevin Warsh.

Boiling frogs by design or accident?

Last week was busy, with earnings season really kicking off. The banks posted good numbers, buoyed by a lot of trading-related volatility during the second quarter.

Japan’s upper house elections saw the ruling Liberal Democratic Party-led coalition lose control of the chamber. It is now in the minority in both chambers, making Prime Minister Shigeru Ishiba’s position particularly tenuous as Japanese households struggle with the return of inflation. The yen rose on an expectation that a future government would provide more support to households, in turn requiring more contractionary policy (higher interest rates) from the Bank of Japan.

Meanwhile, the United States Congress passed legislation to regulate stablecoins − a type of cryptocurrency whose value is pegged to an external reference, such as gold or fiat currencies (national currencies that are backed by the issuing government rather than commodities such as gold or silver). Stablecoins now have a clearer path to broader use in financial transactions.

The bill imposes federal or state oversight on U.S. dollar-linked tokens. Regulatory rules include a requirement for firms to fully back currency values with reserves in short-term government debt or equivalent products, bringing some perceived legitimacy to the crypto industry. It also brings demand for securities, which will help to finance increased government borrowing.

Supporters of the bill believe it could lead to cheaper, faster, and more business-related transactions. Critics, on the other hand, warn that the bill won’t do enough to protect consumers.

The development of the coins could have a macro-economic impact though, as it creates demand for bills that can support government borrowing, but it takes deposits away from the banking system, which could inhibit credit creation.

Have U.S. import tariff costs been passed on to consumers?

Investors have been scouring inflation reports for evidence that companies are passing on the costs of U.S. import tariffs by raising consumer prices. So far, tariff-driven inflation had been the dog that didn’t bark, but last week’s inflation report allowed another opportunity to check. Inflation picked up, but by less than expected. So, another month of no tariff inflation? Not quite.

Source: LSEG

Services prices were suppressed by travel prices (such as airfares and hotel prices) and housing (such as rent). But core goods inflation did pick up, and while the move was not very large, it was quite broad, covering several sectors that would instinctively suffer from import taxes (clothes, appliances, home wears).

This is really the first sign of these moves, and it reflects the fact that many months have passed between the first speculation about import tariffs and their eventual implementation, a process that even now hasn’t finished.

Is this an example of the kind of haphazard implementation that is characteristic of the Trump administration? Or is it a deliberate strategy?

Most economists assume that tariffs are a tax paid by consumers. The political risk is that consumers realise that too. That will be most obvious if you implement the tariffs and then prices go up. However, if you implement tariffs and then prices don’t noticeably rise, then it seems like the government has achieved an immaculate tax hike.

How can that happen? Firstly, you give some warning so that companies buy in a lot of inventory ahead of the tariff increase. Then you increase tariffs a bit, while deferring further increases.

It doesn’t hurt for there to be some ambiguity about what will happen, as happens if you dangle the prospect of trade deals, even though in practice hardly any such deals get done. Exporters don’t want to hike their prices and lose market share if tariffs might be cut again soon, so they suffer the tax themselves for a few months.

The upshot, therefore, is that importers have had the inventories and exporters have had the incentive to keep prices down for the time being, which has put some distance between the tariff announcement and the tariff impact. It means the impact will unfold gradually over time, rather than lurching higher, making it much harder for consumers (or, more accurately, voters) to associate their loss of disposable income with the tariff increase.

Imposing tariffs, like boiling frogs, is probably easier if you do it slowly. Has it made the policies popular? To an extent. The disapproval rate of President Trump and his policies on trade and inflation has stopped worsening since the ‘Liberation Day’ tariffs were partly deferred, although his policies haven’t actually become more popular.

However, what seems significant is that if the policies become embedded, it’s harder to see this, or a future administration removing them. As we’ve discussed before, the trajectory of the budget deficit makes it very hard for either party to give up revenue sources.

The chaotic implementation of tariffs – was it deliberate?

Source: Silver Bulletin

In that sense, the chaotic implementation of the tariffs may help to ensure their permanence. Was it deliberate? Probably not. But what seems more stage managed has been the repeated rumours, and subsequent guarded denials, that President Trump is preparing to fire Federal Reserve (the Fed) Chairman, Jerome Powell.

Last week, Trump met with congressional Republicans in a private meeting, at which he discussed the matter, even showing them a draft letter of termination. News of the meeting was leaked, the dollar fell, the yield curve steepened, and gold and bitcoin rose.

President Trump subsequently said he was probably not going to fire Powell after all, and added that former President Joe Biden had appointed Powell, a falsehood that is so obvious that it would immediately cast additional doubt on the topic. The market reaction was less severe than last time the topic was raised; prediction markets had already assumed a higher chance of it happening and, presumably, they will continue to do so. By repeatedly floating and walking back the idea, the market reaction, when it happens, will be less severe.

President Trump seems fixated on the fact that interest rates should be lower, despite inflation picking up recently. As a result, the shortlist for Powell’s replacement includes Kevin Hassett and Scott Bessent, both members of President Trump’s current economic team. Either would face challenges to being confirmed, as that would appear to undermine the independence of the Fed. More conventional alternatives would be former Fed governor Kevin Warsh or current governor Christopher Waller.

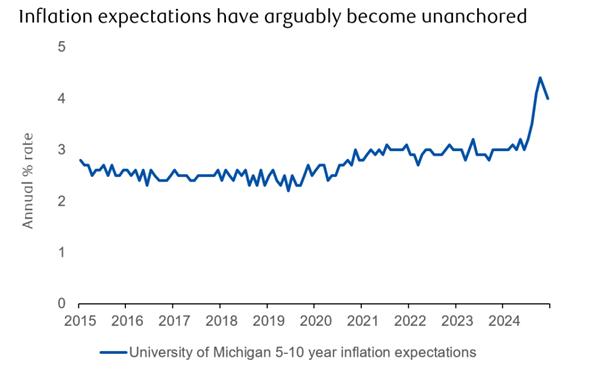

The frontrunners are Warsh and Hassett; but last week, Waller stated his view that interest rates should be cut at the next meeting on 30 July. His view is that the limited evidence of inflation from tariffs will be temporary (which seems likely) and that inflation expectations are unlikely to be unanchored (i.e. they’ve started to move unusually far away from their previous average). This last point is debateable as, by some measures, they have already become unanchored. It’s therefore pretty certain that rates will be held at that meeting.

Source: LSEG

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

23/07/2025