Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 17/06/2025.

Markets calm despite conflict in the Middle East

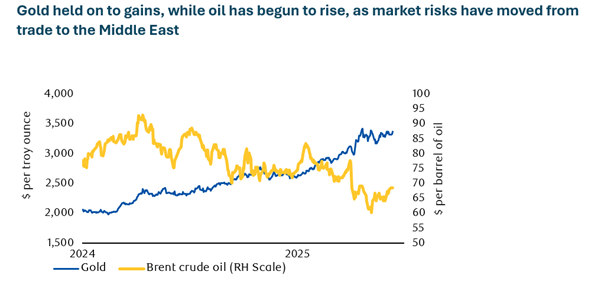

Despite the recent conflict in the Middle East there has been a surprising lack of market movement.

Source: LSEG Datastream

On 12 June, 2025, Israel launched a series of airstrikes targeting Iranian nuclear and ballistic missile facilities, scientists, and senior military personnel, marking a significant escalation in the long-standing conflict between the two nations. The attacks reportedly damaged the Isfahan and Natanz uranium enrichment facilities, whilst also striking the Fordow but with limited success.

Iranian state media confirmed the killing of the Commander of Iran’s Islamic Revolutionary Guard Corps (IRGC), Hossein Salami, however it is the attacks on the nuclear facilities which is of greatest strategic importance as the actions taken so far would slow but not prevent Iran’s progress in enriching uranium to the grade required to develop a nuclear weapon.

In recent months, Iran has made rapid advances in its uranium enrichment activities, with the International Atomic Energy Agency (IAEA) finding Iran in breach of non-proliferation obligations. Israel’s Prime Minister, Benjamin Netanyahu, stated that Iran has enough enriched uranium for nine atomic bombs and insisted that the preventive action was necessary to avert a full-scale nuclear crisis. Israel has indicated that ending that progress is its objective, and it has a strategy to achieve it over a number of weeks.

The situation is volatile, and there is a risk of a wider conflict involving other regional actors. For now, Israel and Iran have been exchanging fire with Israel expanding targets to include energy infrastructure. A particular focus is on the U.S., whose involvement would mark a clear escalation but is assumed to be required in order to do lasting damage to the Iranian nuclear programme. President Trump’s comments on the subject have been vague and laced with implicit threat but so far, the U.S. official line is that it is not a party to this conflict.

Possible options for an imperilled Iran would be disruption of traffic through the narrow strait of Hormuz, however the U.S. Fifth Fleet’s presence in Bahrain makes it unlikely that this can be achieved for an extended period.

The market reaction has been fairly benign so far. That reflects hopes that the conflict can be contained and an assumption that we won’t see the kind of global energy supply interruptions which occurred in the 1970s.

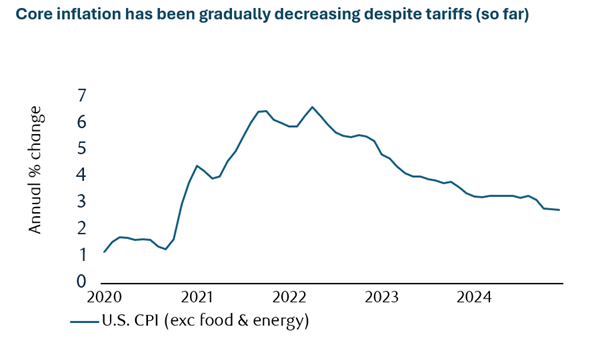

Source: LSEG Datastream

The U.S. Consumer Price Index (CPI) report for May showed a 0.1% monthly increase in core inflation, below expectations for the fourth consecutive month. Despite the current lack of impact from tariffs on inflation, it’s likely that the effects of the tariff-driven boost to U.S. inflation will be felt soon. The effective average tariff rate is currently at 15%, significantly higher than the 2.4% rate prior to Trump’s inauguration, and is expected to add around 1.5% to U.S. inflation. While some categories, such as appliances and toys, saw a notable pickup in prices, others, including apparel and footwear, experienced declines.

The report also highlighted the impact of tariffs on businesses, with some being forced to absorb the higher costs themselves, rather than passing them on to consumers. This is in line with Trump’s stated desire for businesses to eat the tariffs, rather than increasing prices for consumers. However, with the huge surge in imports prior to the tariff increases, businesses may be able to sell their existing inventory without raising prices, which could delay the impact of tariffs on inflation. Nevertheless, with the average effective tariff rate expected to remain high, it’s likely that goods prices will start to rise due to Trump’s tariffs in the near future.

The CPI report also provided insight into the state of the labour market and its impact on inflation. Core services ex-shelter inflation was weak, rising less than 0.1% monthly, which suggests that there isn’t much labour market-driven inflation. This, combined with the decline in airfares and the drop in inbound U.S. tourism, may indicate caution among American consumers.

Shelter inflation also decelerated further, with primary residence rental prices hitting a new cycle low, and measures of new lease inflation signalling that shelter inflation will remain subdued in the months ahead.

The implications of the CPI report for Federal Reserve (Fed) policy are significant. While the Fed has made progress in getting inflation lower, with the six-month annualised rate of change in the core CPI near its cycle low, the risks of cutting rates too early and losing credibility are high. It’s unlikely to cut again until there is a meaningful weakening in the labour market and/or more clarity around the impact of tariffs on inflation. With trade uncertainty still high and the potential for tariffs to boost inflation, the Fed will likely wait for more clarity before making its next move.

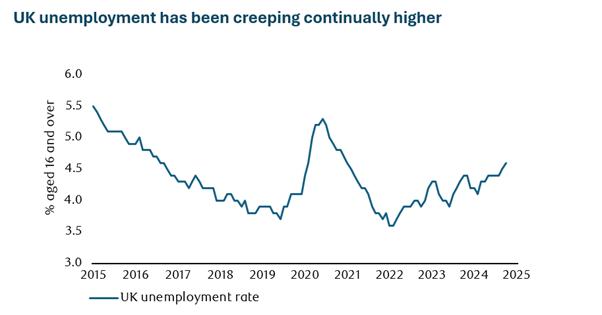

The UK economy is at a crossroads, with recent data releases painting a mixed picture of its health. On one hand, the labour market appears to be slowing down, with payroll employee numbers falling by 109,000 in May, the worst first estimate of payrolls in two years. This decline, combined with a rise in the unemployment rate to 4.6%, gives the Bank of England’s Monetary Policy Committee (MPC) license to cut interest rates again. They’ll probably stay on hold at next week’s meeting, but lower interest rates in August seem likely.

However, other indicators suggest that the labour market is not as weak as the payroll data suggests. The more dated, but less volatile, Labour Force Survey (LFS) showed a healthy increase in employment in April and business surveys have also stabilised or improved since March. The redundancy rate has fallen to its lowest level since before October’s budget.

The Recruitment and Employment Confederation (REC) survey indicates that the worst of the jobs slowdown may be over. The permanent staff placements index is still at an eight-month high, excluding April’s reading, and the temporary staff placements balance rising to a six-month high.

The recent spending review has also shed light on the UK’s fiscal situation, with the government maintaining its commitment to increase overall day-to-day resource spending by 1.2% in real terms on average between 2025/26 and 2028/29. However, this increase is largely driven by a rise in healthcare spending, which will absorb most of the increase in the total spending envelope. The government has announced plans to increase defence spending to 2.6% of Gross Domestic Product (GDP) by April 2027, which will add to the fiscal burden. So, we’re back in a situation where unprotected departments will be asked to make cuts in real terms.

In the housing market, the recent stamp duty hike has caused a temporary slowdown, but overall, the market seems stable. After a strong start to the year, momentum in the housing market has stalled a little. However, the RICS survey showed an improvement in forward-looking indicators, such as price expectations and sales activity, and the sales-to-stocks ratio, although still low, suggests that there’s little overhang of unsold property that would weigh on prices.

The UK GDP data for April suggested that the economy declined, partly due to the weakness of trade and the associated efforts of companies to get ahead of President Trump’s tariffs, but the domestic economy was also sluggish. Overall, the second quarter is on course for a small decline and over the course of the year growth will likely be just about 1%.

So, recession still seems unlikely, but with domestic businesses cutting spending to compensate for increased costs due to tax rises and the government quite constrained in terms of its spending, there seems adequate reason to cut interest rates.

In the UK, government spending is constrained, and interest rates are falling, whereas in the U.S., bond issuance continues at pace and the economy is holding up surprisingly well, all of which suggests that the outlook for UK government bonds is better than that for the U.S. treasuries.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

18/06/2025