Please see the article below from AJ Bell, which outlines a range of analysts’ projections for S&P 500 returns in 2026. It also explores the key factors driving these forecasts and explains why it matters for investors. Received – 15/12/2025.

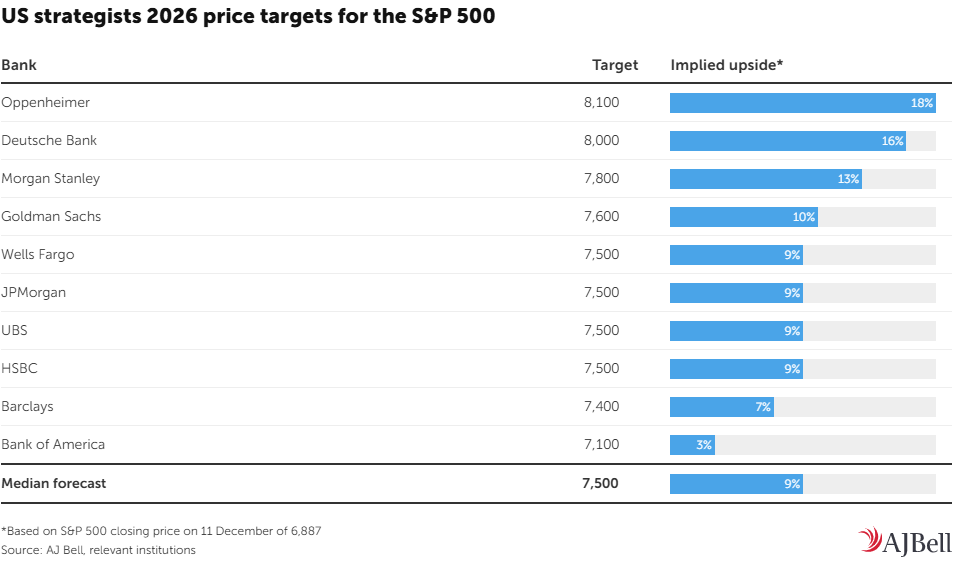

A MarketWatch survey reveals the median 2026 price target for the S&P 500 index from leading Wall Street analysts is 7,500. Based on its current level, this implies a return of around 9% for this key US stock market index next year.

Assuming the consensus is right in 12-months’ time, it would roughly match the long-term average annual return for the S&P 500 over the last century.

Which, in turn, confirms investment analysts tend to be reluctant to go out on a limb for fear of looking foolish.

What about earnings forecasts?

What is perhaps more interesting is that data compiled by FactSet shows analysts are projecting S&P 500 earnings growth of 14.5% for 2026. Given this is faster than the consensus expectation for the increase in the index, it implies valuations will come down. A less than bullish outlook for an analyst community which is typically overly optimistic.

FactSet have calculated that on average over the last 25 years analysts have overestimated earnings by around 6%, while studies have shown S&P 500 predictions are nothing more than a coinflip.

Looking at the range of predictions, Bank of America is the most cautious and one of the few investment banks explicitly forecasting valuations to ease from their current levels thanks to a slowdown in enthusiasm for artificial intelligence and reduced share buybacks as big tech firms divert cash into AI spending.

At the other end of the spectrum, Oppenheimer is the most bullish, with a price target of 8,100, implying 18% growth.

It is not alone in expecting mid-teens returns for the S&P 500 with Deutsche Bank and Morgan Stanley also in this camp.

What is expected to push US stocks higher?

The case for these sorts of gains rests on strong corporate earnings growth, driven by the technology sector, as well as economic resilience and a supportive monetary policy backdrop with further rate cuts from the Federal Reserve.

While some analysts have voiced concerns over elevated valuations, they are also making the case for valuations staying high. “We expect equity valuations to remain elevated,” comments Deutsche bank.

Why it matters to investors

While predicting the S&P 500 is nigh-on impossible, what happens to the benchmark index is not trivial for investors.

This is because the S&P 500 index is one of the most widely followed financial benchmarks in the world.

Parent company S&P Global has stated that between $13 trillion and $15 trillion of assets are tied to the index via passive ETFs (exchange-traded funds), active funds and derivatives.

The index tracks the performance of 500 leading publicly traded companies, capturing around 80% of the total US equity market, and has a total market value of close to $60 trillion. US shares, in turn, make up around 70% of major global indices like the MSCI World and FTSE World.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Marcus Blenkinsop

22nd December 2025