Please see the below article from Brooks Macdonald detailing their thoughts on a recently sworn in Trump administration. Received this morning 21/01/2025.

What has happened

With US financial markets closed yesterday, investors instead watched Donald Trump being sworn in as the 47th US president. President Trump subsequently wasted no time in signing a raft of executive orders tightening immigration, ending green energy incentives in favour of oil and gas, and (albeit late in the day yesterday) planning tariffs on Canada and Mexico. Equity futures markets, which had earlier rallied on the lack of tariff news, subsequently retraced some of those gains, while the US dollar which had weakened earlier in the day, saw a jump up against most major currencies.

Trump ends green energy incentives

US President Trump yesterday ordered an “immediate pause” in spending on clean energy and other climate initiatives, deriding former US president Biden’s signature climate law (the ‘Inflation Reduction Act’) as the “green new scam”. Trump also ordered the US Environmental Protection Agency to consider eliminating the ‘social cost of carbon’, a metric used to help justify environmental policies. Earlier in his inaugural address, Trump defended a renewed energy focus on oil and gas production, saying that “we have something that no other manufacturing nation will ever have: the largest amount of oil and gas of any country on earth. And we are going to use it”.

US Trump trade tariff plans

Overnight, President Trump has said he plans to impose previously threatened trade tariffs on Canadian and Mexican imports into the US, saying that “we’re thinking in terms of 25% on Mexico and Canada … I think we’ll do it February 1st”. Trump also threatened to apply higher tariffs on Chinese imports as well as tariffs on European Union imports. However, while Trump indicated he was still considering a universal tariff on all foreign imports to the US, he added that he was “not ready for that yet”.

What does Brooks Macdonald think

In the past 24 hours, financial markets have had an early reminder of what life will be like under a US Trump administration. In particular, overnight we have seen volatility in markets as an initial relief around the absence of immediate sweeping tariffs has given way to nerves following Trump’s announcements of his Canada and Mexico trade levy plans late in the day. One early takeaway from all this is that Trump is likely to be highly ‘transactional’ in his approach to tariffs as well as other policy areas too potentially – that could make it very hard indeed for investors to anticipate and plan for overall policy narratives and expected economic and market impacts.

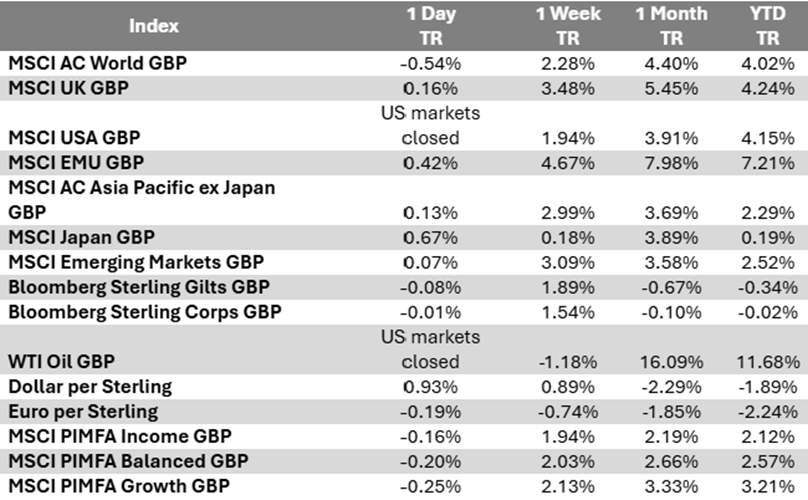

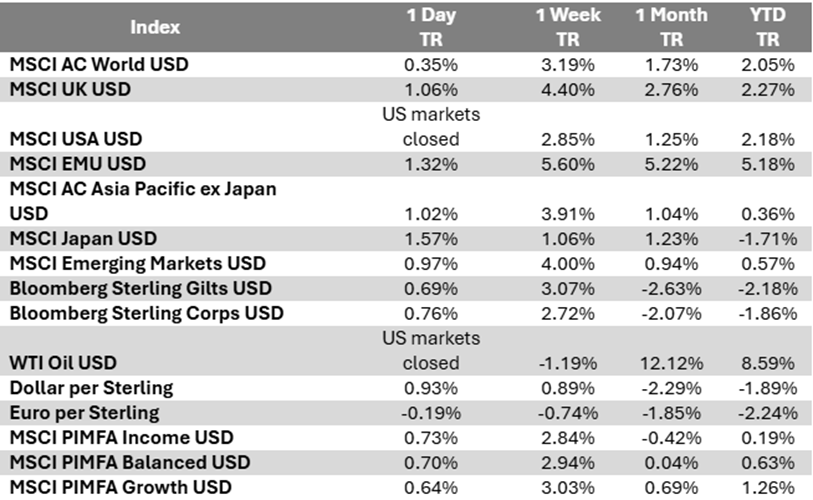

Bloomberg as at 21/01/2025. TR denotes Net Total Return.

Please continue to check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

21/01/2025