Please see below article received from Brooks Macdonald this morning, which provides a global market update for your perusal.

What has happened

At an aggregate equity markets level, there wasn’t a big catalyst for moves in either direction yesterday. By the close on Monday, the US S&P500 equity index was up +0.39%, while the pan-European STOXX600 equity index was down marginally at -0.06%, both in local currency price return terms. Elsewhere, a fade in recent US dollar strength coupled with a reminder of geopolitical risk around Russia-Ukraine helped buoy the Brent crude oil price, which gained +3.18% to US$73.30 per barrel yesterday.

Tesla has a very good US election

Tesla’s share price has so far had a very good US election. From the close on the day of the election on 5th November through to yesterday’s close the stock is up almost +35%, and in the process adding around US$280bn to Tesla’s market capitalisation – a gain alone that is slightly bigger than the total market size of Toyota (at around US$276bn equivalent), the world’s second largest auto company after Tesla. That Tesla gain includes a sizeable +5.62% surge in the Telsa share price yesterday and came on the back of a Bloomberg report that US president-elect Donald Trump’s upcoming administration is planning to make a US federal framework for self-driving cars a priority.

Chinese ETF investor outflows

Exchange Traded Funds (ETFs) that buy Chinese stocks have seen continued outflows according to a Bloomberg report yesterday. As an example, the US$8.2bn iShares China Large-Cap ETF saw US$984 million in outflows last week, its largest weekly outflow on record, and extending a five-week streak of withdrawals for that ETF. Chinese equity investor sentiment has been under continued pressure in recent weeks on two counts: (1) investors harbouring lingering concerns that Beijing’s stimulus will not prove to be enough to lift consumer spending; and (2) the impact on Chinese businesses from the risk of materially higher US tariffs under Trump.

What does Brooks Macdonald think

It must be a very frustrating time for those in the market who continue to be bearish on the US economy. Even excluding the current enthusiasm around the prospect of tax cuts, deregulation and greater fiscal deficits under Trump, the US economy appears to be doing just fine currently. According to the Federal Reserve Bank of Atlanta’s ‘GDPnow’ forecast model yesterday, US real (constant prices) Gross Domestic Product (GDP) growth is expected to be running at +2.5% annualised for the current calendar 4Q of 2024 – if that turns out to be the actual number, that would be above the US Federal Reserve’s longer-run GDP annual growth assumption for the US economy of +1.8%.

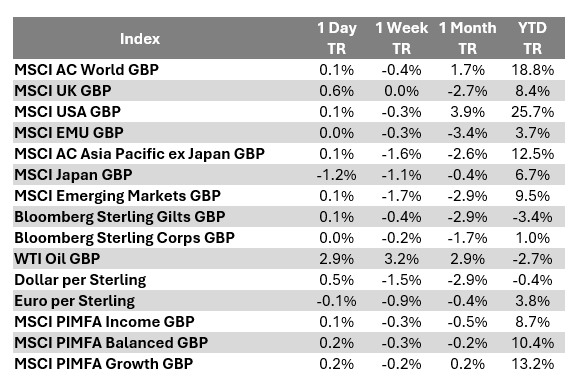

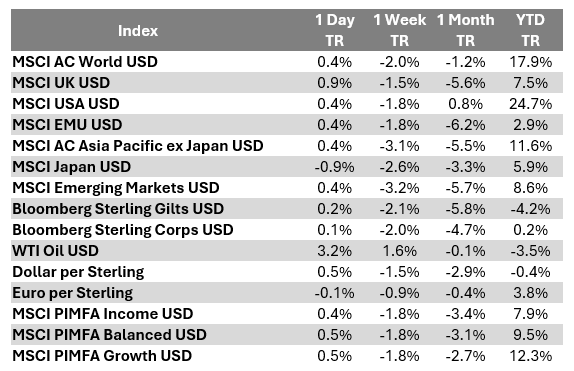

Bloomberg as at 19/11/2024. TR denotes Net Total Return.

Please check in again with us soon for further relevant content and market news.

Chloe

19/11/2024