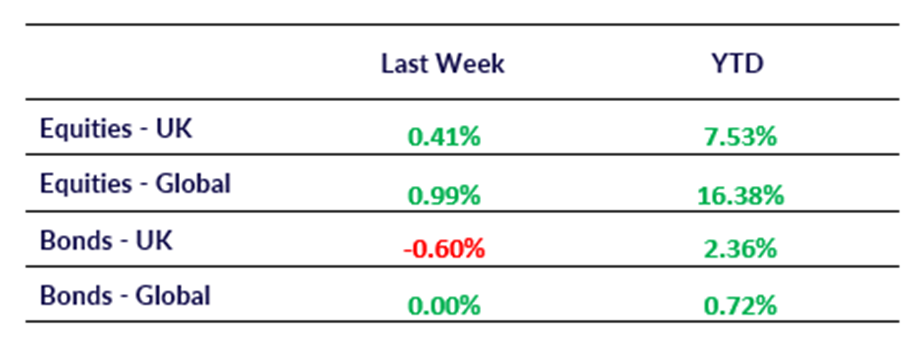

Please see below, a short update from Copia:Capital which illustrates key recent figures from financial markets. Received this afternoon – 03/01/2024

Last Week:

- Global stock markets recorded their strongest year since 2019 after markets rallied for the last two months of the year. The MSCI World Index, which is a measure of the world’s developed equity markets, finished up 22 per cent over the course of 2023. This was largely led by the S&P 500 index was up 24 per cent over the year and rose 14 per cent since October.

- Asset managers launched the lower number of funds in the UK in 20 years. Morningstar reported that 397 funds were launched during 2023 which was down a quarter from the year before and much lower than the 899 launched at the peak in 2010. The drop in demand for funds came after investors shifted towards cash funds to avoid higher volatility.

- There was record inflows into US money market funds in 2023 as investors were drawn to the high risk-free yields offered. Asset passed $6.3trn in US money market funds and US money market fund providers collectively earnt $7.6bn in fees over the year from these funds. The rates in money market funds have been much higher than previous years as a result of higher interest rates while the added volatility in equity markets have pushed more investors into money market funds.

Coming Up:

- US Initial Jobless Claims data released, Thursday 4th January 2024 at 1:30pm.

- EU December CPI data released, Friday 5th January at 10:00am.

Please continue to check our blog content for advice and planning issues from leading investment houses.

Alex Kitteringham

3rd January 2024